Fraud Detection Machine Learning: How It Keeps Businesses Safe

News on fraudulent activities appears in the media with disturbing frequency. Statistically, the losses that the global economy suffers as a result of fraud have dramatically increased by 49.5% since 2008.

One of the biggest challenges is linked to detecting and preventing various types of fraud ranging from identity and data theft to accounting and financial fraud. Inevitably, it raises the question about tools that can combat fraud while demonstrating the wider capability of application across multiple industries.

In particular, sectors demanding anti-fraud solutions most are e-commerce, gaming, banking, finance, and healthcare.

Transaction fraud detection machine learning tools are gaining popularity as they significantly empower organizations with opportunities of:

identifying potential risks instantly

bringing more successful and predictable business outcomes.

Fraud Detection Machine Learning: When You Know How to Predict

Fraud model machine learning algorithms are based on simultaneous analysis of thousands of data sources, which provides a high level of machine learning fraud protection.

Artificial intelligence fraud detection relates to security. To mitigate risks and deliver precise compliance & reinforce security, artificial intelligence, and ML-powered tools feature functionality that can:

detect fraudulent transactions

spot suspicious behavior in real-time

signal of preventing fraud

improve the transactional history of businesses.

Types and Techniques Of Fraud Detection

Mostly, businesses try to secure and facilitate their operations by utilizing the following four types of fraud detection:

Creating reputational lists

It implies decision-making upon building a reputational database (for instance, blacklisting emails, device fingerprints, IP addresses, or phone numbers) and matching against lists. This type has obvious limitations due to the static nature of the database opening ways for bypassing the system.

Introducing rule engines

It detects fraudulent activities from the account characteristics perspective and enables checks based on the combination of rules and logic. While it is a step-up type comparing to reputational lists, it still has limitations due to difficulties of lists maintenance and leaving room for designing the way of attacking the system once the rules are being disclosed.

Supervised machine learning(SML)

In this case, a mathematical algorithm learns to perform certain tasks based on examples fed by data. ‘Feeding’ data will have the studying effect once it is linked to observation labeled data. Thus, labeling data is the mandatory requirement in SML. The limitation of taking this approach pertains to the complexities of the training data process (in terms of quality and quantity). In particular, SML can hardly be effective in the prevention of new fraudulent schemes.

Unsupervised machine learning

This is an algorithm that can identify fraud-related linkages and patterns without having prior knowledge of what precisely to search for. What makes unsupervised learning the most advanced type is its flawless fraud detection capability that does not require labeling data. Unsupervised machine learning can identify suspicious behavior or unusual patterns “ahead of data training”. It is the future of machine learning as it saves tons of time and human efforts.

Although fraud detection unsupervised machine learning has a huge computational cost, its two major advantages are:

ability to detect unknown attacks

ability to provide auto-label generation

Below, we discuss fraud detection machine learning examples that show a rate of successful application in various industries and demonstrate the positive impact of machine learning on business.

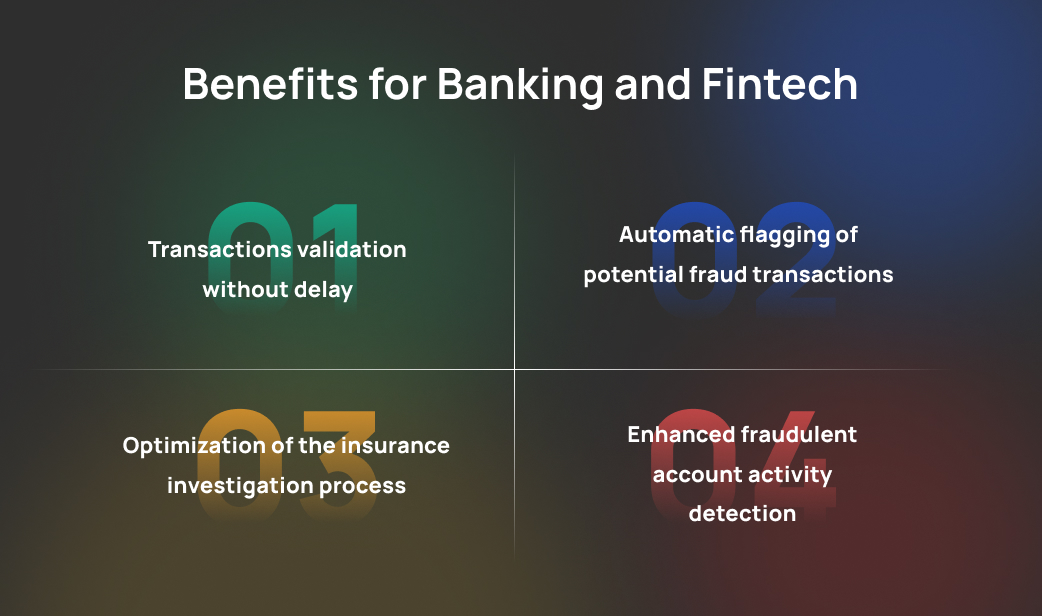

Fraud Detection Software in Banking and Fintech

The demand for anti-fraud solutions is determined by the alarmingly frequent occurrence of fraudulent transactions in banking.

The notion of machine learning in fraud detection implies that banking fraudulent transactions have identifiable features differing them from legitimate transactions. It allows machine learning algorithms to detect patterns in banking transactions and categorizing them in terms of legitimacy.

Credit card fraud detection is one of the widely-known applications of machine learning.

Historical payment data feed and train algorithm for further validation of coming transactions within extending databases of transactions with credit cards. It enables banking systems to block fraudulent transactions in real-time.

Why are AI-powered fraud prevention tools compulsory?

Businesses can enhance bank customer satisfaction by delivering a high level of protection of their accounts and validating transactions without any delay.

Banks and financial organizations can save money on legal disputes by flagging transactions that seem or prove fraudulent.

For the category of machine learning to detect insurance fraud along with signs of fraudulent activity in insurance claims, the benefits of applying ML-powered tools come to optimizing the cycle of insurance investigation that otherwise would be excessively time-consuming.

Utilizing artificial intelligence to detect fraudulent account activity proves to be the most efficient strategy in improving business operations without taking efforts for extra programming.

Ultimately, fraud detection in banking using machine learning delivers precise predictive maintenance models that can spot fraudulent activities.

Fraud Detection Machine Learning in E-commerce

With e-commerce spending on the rise, it comes as no surprise that this industry belongs to one of the most vulnerable to scams, malware, and fraud.

The big data accumulation in e-commerce brings myriads of opportunities to evolving businesses but at the same time creates challenges of data breach and potential frauds with credit cards and user personal information constantly targeted by attackers. Although traditional fraud detection systems have been deployed, they cannot face challenges stemming from an imbalance of the used data.

To prevent compromising users’ data, business e-mail malfunction, data misuse, or denial of service and provide a seamless customer experience, e-commerce businesses stay aware of potential fraud risks and take measures accordingly.

In particular, they actively use ML-based fraud detection in e-commerce and deploy machine learning consulting services.

How can machine learning detect fraud in e-commerce?

With supervised and unsupervised machine learning, the algorithm can easily detect:

inconsistency of presented information

discrepancies in account history

unusual numbers of purchases against time estimates

suspicious using of credit cards (multiple decline scenarios, etc.)

mismatching of details in billing addresses.

Hence, fraud detection machine learning in e-commerce businesses lessens the negative effects of fraud attacks, delivers e-commerce payments fraud prevention, and protects users from identity theft, account takeover, or compromising their data.

Fraud Prevention in Gaming

With the multi-billion profits of the gaming industry, the question of how AI can be used in fraud detection is not a trivial one. To ensure risk scoring precision, lots of gaming platforms develop various anti-fraud modules.

They enable systems:

to provide analysis of suspicious, potentially fraudulent activities within the time frame of a gaming session or at the stage of purchasing

to detect fraud with identity verification

to prevent credit cards fraud

to monitor and block creating fake teams

to spot transactions from multiple accounts

to identify fake friend requests, scamming links, etc., and automatically add occurrences to the database for further generating predictive fraud prevention models to frustrate any fraudsters’ attempts.

Fraud Detection Machine Learning For Healthcare

Healthcare belongs to the industries that are rapidly deploying machine learning algorithms to achieve several goals. Aside from automating time-consuming tasks and providing a highly personalized customer experience, multiple machine learning use cases in healthcare pertain to fraud detection as well.

Specifically, healthcare providers take a supervised and unsupervised machine learning approach in investigating claims frauds as they are impacting the increase of healthcare costs considerably. With effective solutions for fraud detection, this process can be taken under control.

One of the effective ways in this domain is anomaly detection that allows identifying patterns in peculiar characteristics.

Spotting how they frustrate the models built on expected operations within datasets, the algorithm:

contributes to the improvement of medical outcomes

operationalizes business transactions in the healthcare

lessens the impact of fraudulent activities.

For instance, with ML-powered tools for fraud detection, healthcare businesses practically eliminate the chance of providing nonexistent medical services.

The Concluding Thought

The recent shift to the global online presence of businesses has brought a considerable acceleration in utilizing AI and ML due to their high capabilities in real-time fraud detection machine learning.

Automating the process of differentiation of potentially fraudulent transactions and delivering precision of fraud detection greatly benefit businesses, preventing damages and losses.

Specifically, fraud detection with machine learning has been on a steady rise in e-commerce, finance, and healthcare-related sectors while clearly demonstrating the improvement of experience both for consumers and business owners.

FAQ

This is a set of security measures that involve the latest developments and high technologies for the timely detection of any suspicious activities, accounts, transactions, requests, and more.

Thanks to AI-powered solutions, automated and high-speed simultaneous verification of a huge amount of data, transactions, and actions is achieved, which greatly reduces resource costs and improves the quality of analysis.

Such an algorithm is able to quickly evaluate large amounts of data, allowing it to automatically find any inconsistencies in the data, suspicious actions in the past and present, and so on. Machine Learning algorithms are used to detect fraud in all industries.

Build your ideal

software today