How To Create a Trading Platform

The stock market app market has been growing steadily since 2016, with the Robinhood app winning the race. Moreover, it is projected to keep growing with 6.4% annual growth on average during the next ten years.

The adoption rate of smartphones is at its historical peak, with over 90%, promoting the continuous growth of the user base. Moreover, Motley Fool, a private financial and investing advice company, says that Gen Z and millennials are the fastest-growing group of investors.

What Is A Trading Platform?

A trading platform is a web-based or mobile trading app that offers access to valuable features. Using the functionality, investors, traders, and other users can easily buy/sell stocks, bonds, shares, crypto, etc.

The three core features of a basic trading platform include:

- Brokerage integration. API integrations with brokers to facilitate stock trading and brokerage account management.

- Market data fetching. Live-time quotes, price feeds, and other financial data.

- Charting and analysis. Charting tools with a variety of indicators, trend lines, and drawing tools.

Features of Custom Trading Platform

Custom-built trading platforms enable the opportunity to go beyond basic functionality and—hence—get a competitive advantage over competitors. The trading app development unleashes the opportunity to create a workflow-tailored system with advanced features, including:

- Algorithmic trading. Create custom presets and user agents for automated trading.

- AI-analysis. Implement Artificial Intelligence to analyze datasets and detect hidden patterns.

- Advanced data visualization. Compose custom charts using advanced tools for visualizing indicators.

- API integrations. Enrich the functionality and create automated workflows by integrating third-party solutions.

- Advanced security. Implement multi-tier security measures to keep financial data safe.

The guide below is a detailed roadmap for creating a top-tier application. It covers essential stages from defining your goals and validating your idea through market research to preparing crucial documents and selecting the right technologies.

Trading Software Development Guide

Building a trading platform involves many crucial stages. To create a top-tier application and succeed, feel free to follow the stock trading software development guide prepared by our team.

Step 1: Define Goals and Validate Idea

For starters, you need to analyze the problems a custom trading platform can help solve. It will help you define your goals. You need to clearly understand what result you strive to achieve by creating a custom solution from scratch.

For instance, here are some of the goals you may achieve by developing a trading platform:

- Improved oder management system

- More significant amounts of data fetched and analyzed

- Lowered commission fees

- Use of custom trading algorithms

- Better user experience

- Helpful notifications

- A larger number of payment gateways

By analyzing the problems that need to be solved, you can form a list of the core features that a new trading platform should have. Moreover, you need to consider if you want to build a brokerage app for trading stocks or cryptocurrency.

Also, conducting business analysis is advisable to validate your idea and research the market. Feel free to explore the advantages and disadvantages of your competitors.

According to the research conducted by BusinessofApps, the top five trading apps on the market by the number of users are:

- Robinhood: 16.3 million users

- Cash app: 4.8 million users

- eToro: 3 million users

- Webull: 2.7 million users

- Plus500: 2.2 million users

Competitor analysis will help you form a unique selling proposition (USP). It is a set of features that will help your trading platform stand out from the crowd and overcome your competitors. It should convince potential users to choose your stock or crypto trading platform over other solutions available on the market.

Need help in conducting a business analysis?

Business First

Code Next

Let’s talk

Step 2: Prepare Input Artifacts

When you’re ready to build your own trading platform, it’s recommended to prepare input artifacts. They will help you avoid bottlenecks and unforeseen expences.

To make the trading software development seamless, prepare the following input artifacts.

Product vision

Product vision is a document that defines the primary aims of developing a custom trading application. Moreover, it comprises long-term product development goals. The strategic vision of a product helps create a coherent back-end development roadmap and onboard team members effectively.

Type of stock trading app

There are three options available for building your own trading platform.

You can build a trading app for:

- Mobile devices

- Desktops

- Web browsers

Let’s check the pros and cons of these three types of trading software applications.

| Pros | Cons | |

|---|---|---|

| Web-based | Fast access via an URL Simple upgrade of functionality Work on most mobile and desktop devices | Reliable Internet connection is required Need to be optimized for different browsers Possible performance issues |

| Mobile | Easy to use on the go Push notifications Fast work and access to crucial data Convenient user experience | Several platforms need to be considered (iOS, Android, iPadOS) Applications needs to be approved by AppStore and Google Play for further listing Lack of screen space Apps need to be upgraded on the users’ end |

| Desktop | Enhanced security Great performance Lowered hosting fees Can be shared over the Internet | Several types should be developed for various platforms (Windows, Linux, macOS) Need to be updated manually by users |

User roles

Defining user roles is recommended before the development of a stock trading app begins. There are two main types of user roles in a trading platform. They are:

- Admin — Privileged users who can configure how an e-trading system works, update algorithms, install updates, manage other users, etc.

- Trader — The majority of users who use the functionality of an online trading platform to buy/sell shares of stocks or cryptocurrency. Users of this role can have different permissions and access to various features.

Stock trading app features

It’s vital to consider the functionality before you begin developing a trading platform. The number of features isn’t limited, so you can create any functionality to streamline online trading.

In case you don’t have a solid understanding of how to create a trading platform, check out the list of crucial features to develop.

Let’s untangle the core features to understand how to create a trading platform.

| Feature | Detailed description |

|---|---|

| Authentication and user profile | Users need to quickly sign up for an online trading platform. Also, they need to be able to log in fast using biometrics like TouchID or FaceID. Traders need to have access to their profiles for updating data. |

| User onboarding | Guides, suggestions, and useful tips should help new users quickly grasp how to use new software and its functionality. |

| Newsfeed | A customizable list of news fetched from different sources. AI-powered news aggregation tools can supply traders with recent industry news. |

| Dashboard | A homepage that displays the most crucial data. Users should be capable of configuring dashboards according to their needs and trading stocks to access essential data quickly. The information displayed on a dashboard needs to be updated in live time. |

| Secured payments | Secured payment processing should offer the opportunity for traders to top up their balances and withdraw money fast and stress-free. |

| Order placement | Traders should have access to all the functionality that enables an order matching engine. Also, it’s recommended to develop functionality to place orders in bulk for basket trading. |

| Watchlist | A separate screen that displays shortlisted shares of stocks or cryptocurrencies. The watchlist allows tracking their price or other criteria in live time. |

| Portfolio | It presents information about shares of stocks or cryptocurrencies a trader holds. Also, the portfolio management functionality offers a summary of trading success. |

| Notifications | Instant alerts on news, price changes, or other events that a trader can set. Push notifications should overlay other apps and play sound that draws users’ attention. |

| Tradng analytics | Detailed reports on trades and stock price forecasts help traders build data-baked strategies. |

| Algorithmic trading | Ability to create custom algorithms that analyze data and place orders automatically for algorithmic trading. |

| Search and filtering | Option to search for specific stocks of cryptocurrencies. Also, an online trading platform needs to offer the opportunity to filter search results by certain values. |

Want to discuss your feature set?

Business First

Code Next

Let’s talk

Monetization model

A custom trading app should have a certain monetization model to become profitable.

The most popular monetization models for trading platforms are the following:

- Subscription — Users pay a monthly subscription fee to access the tools offered by a custom trading platform.

- Freemium — Basic features of an online trading platform are provided for free. However, traders are provided with access to advanced tools for an additional fee.

- Trade fees — Users pay commissions when they buy or sell shares of stocks or other assets.

- In-app ads — Advertisements are shown to custom trading platform users.

Choosing a monetization model is vital to make your app attractive to users and overcome counterparts.

Technical requirements

Create a list of technical requirements so developers understand how to create a trading platform that will meet your needs.

Technical requirements may vary depending on the type of trading software you want to develop. Nevertheless, the main points that should be considered are:

- Required speed of work — The speed of placing orders is crucial for trading. Therefore, it’s essential to specify the speed of an app’s work.

- Wireframes — A blueprint that helps developers understand how to build trading software by discovering the way traders will use an application.

- Load — The maximum expected number of users who will use a trading application simultaneously.

- Supported devices — The selection of devices and operating systems that support an online trading platform. For instance, a mobile trading app should work on iOS, Android, and iPadOS devices.

- Regulatory compliance — Financial sector is highly regulated and meticulously monitored. Therefore, it’s required to research and consider financial regulations.

Step 3: Create UI/UX Design

The primary aim of UX design is to help achieve business goals. Therefore, it’s necessary to analyze business requirements to create a mockup of your trading application.

Also, designers should create a company’s logo, pick the color scheme, and set user interface design guidelines. It will help keep consistency when running front-end development and support a well-structured information architecture.

In case you don’t have a solid understanding of how to make an automated trading software design, feel free to create several different mockups and choose the best one.

Step 4: Choose Tech Stack and API Integrations

Developers must pick the right technologies to build a brokerage app that matches all the requirements. They need to analyze the top programming languages for finance and choose the best for your project.

Share all the input artifacts with software engineers so they can offer the best solution to achieve the desired result.

Since trading platforms need to have a lot of helpful features and integrations with other services, selecting the required application programming interface (API) integrations is also recommended.

The most popular API integrations used for developing custom software are the following:

- Yahoo Finance API — It offers access to a large amount of financial data like charts, statistics, historical data, analysis, etc.

- Alpha Vantage API — It helps explore one of the largest historical databases. Also, the API can help track real-time changes in stock and cryptocurrency prices.

- Finage API — It is a comprehensive financial technology (FinTech) that offers the opportunity to track the latest prices and convert currencies.

- Twelve Data API — It helps traders track changes in a broad range of stocks, cryptocurrencies, and other assets. The API’s core feature is live-time updates on growing and least popular stocks.

- Alpaca Trading API — This commission-free API grants traders instant access to curial information about popular stocks and assets. Also, it has a convenient charting tool.

- IG Trading API — It helps get real-time market prices and other solutions provided by the IG company.

- Zirra API — It grants access to more than 100 signals for time series forecasting and cutting-edge insights created using machine learning (ML).

Develop a trading app for time series forecasting with CodeIT.

Also, software engineers need to choose a database solution and implement the best database security practices. They will help keep confidential and payment information safe from leaks. The top five databases used by developers when building trading platforms are:

Project managers can estimate a project using all the gathered information about trading software and provide an approximate budget range and time frames. Also, they will be able to develop a thorough roadmap on how to build a stock trading app.

Get your project estimated by our experts for free!

Business First

Code Next

Let’s talk

Step 5: Onboard Developers

When building a trading platform, you can gather in-house developers or hire a dedicated team of software engineers.

In any case, it’s required to onboard them to a project and share all the information. All details about your project will help developers clearly understand how to build the stock trading platform you need.

The main activities at this stage are:

- Product vision and technical requirements presentation

- Configuration of task management and communication environments

- Tasks backlog creation

- Code quality standards setting

Step 6: Develop MVP

First, you need to plan the first release and compose a coherent plan to develop an MVP, the first version of your product. It should imply the minimum number of features to solve main business goals.

When the Agile product development approach is applied, it’s required to begin the trading software development by creating a sprint backlog of tasks. Consequently, developers will have a set of tasks for a certain period.

Agile is one of the most popular software development methodologies. It helps establish an iterative product development process. Iterations are called sprints and last from one to four weeks. At the end of every sprint, developers need to review their progress.

Step 7: Test Trading App

At this stage, a team of quality assurance (QA) engineers must meticulously check the developed MVP. They need to examine all the features to ensure they work as designed.

If an MVP doesn’t pass the acceptance testing, QA engineers need to prepare reports and deliver them to software engineers so that they can fix all the issues discovered.

Step 8: Release MVP

When acceptance testing is passed, developers should set up a live server and release an MVP. You can make your trading app accessible to everyone or provide limited access to a selected group of users.

The two most popular solutions used to host online trading platforms are:

Don’t hesitate to survey users of your trading platform to collect feedback from real users. It will help you focus on developing the most requested features to satisfy users’ needs and develop a top-tier platform.

Step 9: Upgrade and Maintain Trading App

Maintain your trading app to ensure 100% uptime of your application. Also, create a prioritized list of new features to enhance the functionality of your online trading platform.

Looking for experts who know how to create a trading platform?

Business First

Code Next

Let’s talk

Advanced Technologies For Trading App

Supercharge your custom trading application with top-tier technologies listed below. They help enhance functionality, performance, and user experience.

1. Artificial Intelligence

Apply AI algorithms to turn large datasets of historical data into useful insights. The technology is capable of finding hidden correlations between parameters to unleash new patterns and predict price change accurately. Also, it can detect unusual/suspicious activity.

Application example: Algorithmic trading software is run by custom presets that are based on AI-driven market data feeds and predictive models.

2. Blockchain

Enable transaction transparency and top-tier security with blockchain technology. Create a decentralized trading platform, comprising risk management tools to reduce fraud and enhance trust among users.

Application example: Blockchain technology helps facilitate peer-to-peer trading without the need for intermediaries.

3. Natural Language Processing

The natural language processing technology unlocks the opportunity for traders to automatically analyze news, social media, and other data available online to facilitate information search. The technology is helpful for extracting the most relevant information and briefly citing latest news and research.

Application example: An NLP-enabled software analyzes news articles, reports, and social media publications, extracting the key financial news regarding the key rate.

4. Cloud Computing

The usage of cloud-based infrastructure is beneficial for processing large amounts of data. Cloud servers provide the opportunity to adjust the storage capacity and computing power to meet the changing demand. The flexibility of a cloud-based infrastructure helps quickly deploy new features and updates.

Application example: A cloud-based software is used to handle large volumes of trading data and traffic during peak times.

Benefits Of Custom Trading Software

The development of custom-made software helps traders avoid the need to use isolated solutions for performing daily activities. The foremost benefits of developing custom trading applications are as follows.

Tailored To Specific Needs

Custom stock trading platform development enables the opportunity for traders to use a single platform with a custom set of features. Develop a tailor-made trading application that is perfectly aligned with your workflows and helps automate all the bothersome activities. Also, the usage of a custom trading software enables the opportunity to adjust the user interface (UI) and create custom dashboards.

Adaptability and Scalability

Avoid the limitations of out-of-the-box solutions by unlocking the opportunity to upgrade your software. Stay on top of the competition by constantly developing and releasing new features that facilitate and automate trading operations. Update your software to ensure it can tackle the increasing numbers of users, transactions, and data. Also, complete flexibility enables the integration of advanced technologies to gain comprehensive market insights and process large amounts of historical data.

Improved Security

Ensure your transactions and assets are safe with custom software comprising the most advanced security measures. Implement advanced security protocols, such as multi-factor authentication, bank-grade encryption, and regular security audits, to protect sensitive financial data. Additionally, guarantee compliance with regulatory requirements such as the General Data Protection Regulation (GDPR), Financial Industry Regulatory Authority (FINRA), and Securities and Exchange Commission standards.

Optimized Performance

Get your transactions processed fast and obtain real-time data updates. Adjust the parameters of your system, upgrade the architecture, or implement additional measures for shortening the time required to fetch and analyze financial data.

Third-Party Integration

Integrate the functionality of software released by other vendors to enrich your single trading tool. Integrate your software with financial data providers, payment gateways, and other business tools. Develop custom APIs to ensure smooth communication between various systems for real-time trading.

Let’s build a custom trading platform

Business First

Code Next

Let’s talk

Tips For Trading Software Development

Comprehensive planning and meticulous execution are the cornerstones of successful stock trading platform development.

Scroll down to discover the top tips that will help you run the fintech development process smoothly and avoid budget overrun.

1. Understand Project Requirements

It’s crucial to clearly understand the needs of developing a new trading software. Define the core problems needed to be solved with a new digital tool. The focus on the crucial features helps avoid wasting time and budget. Also, it’s recommended to prioritize the features to get the most valuable functionality available for testing in your MVP.

2. Focus on User Experience

Get crucial information displayed on the main screen of your trading app. Also, use the user-centered design approach to enable intuitive navigation without examining user guides. Optimize the UX for your workflows to perform the foremost tasks quickly and avoid unnecessary clicks and data inputs.

Conduct user experience interviews and usability testing to gather feedback and refine usability features. Ensure the integration of API keys for secure access and provide options to manage a user profile for a personalized experience.

3. Ensure Security and Scalability

Implement strong security measures to keep your financial data secure. It’s advisable to develop end-to-end encryption, encrypted communication channels, two-factor user authentication, and API security protocols.

Understand the future needs of your software to build an easy-to-scale trading platform architecture. If you start with a monolithic architecture releasing the core functionality fast, you may need to refactor your application in the future to integrate a large assortment of new features.

For trading platforms, consider obtaining a cryptocurrency trading platform license and working with licensed payment gateway suppliers to ensure the secure handling of transactions. Also, enhance user trust by meeting standards of organizations like the Securities Investor Protection Corporation (SIPC).

4. Optimize Software

Assess the developed software architecture and define processes that can be further improved by developing new algorithms or removing bottlenecks. Ensure your software works at its maximum capabilities, instantly delivering financial data and handling transactions fast.

5. Create Documentation

Compose technical documentation to help developers understand how your trading app is built. Using the documentation, you can onboard new developers so that they don’t waste time examining how a system works and how to implement new features. Keep your documentation up-to-date with every release and change in the software.

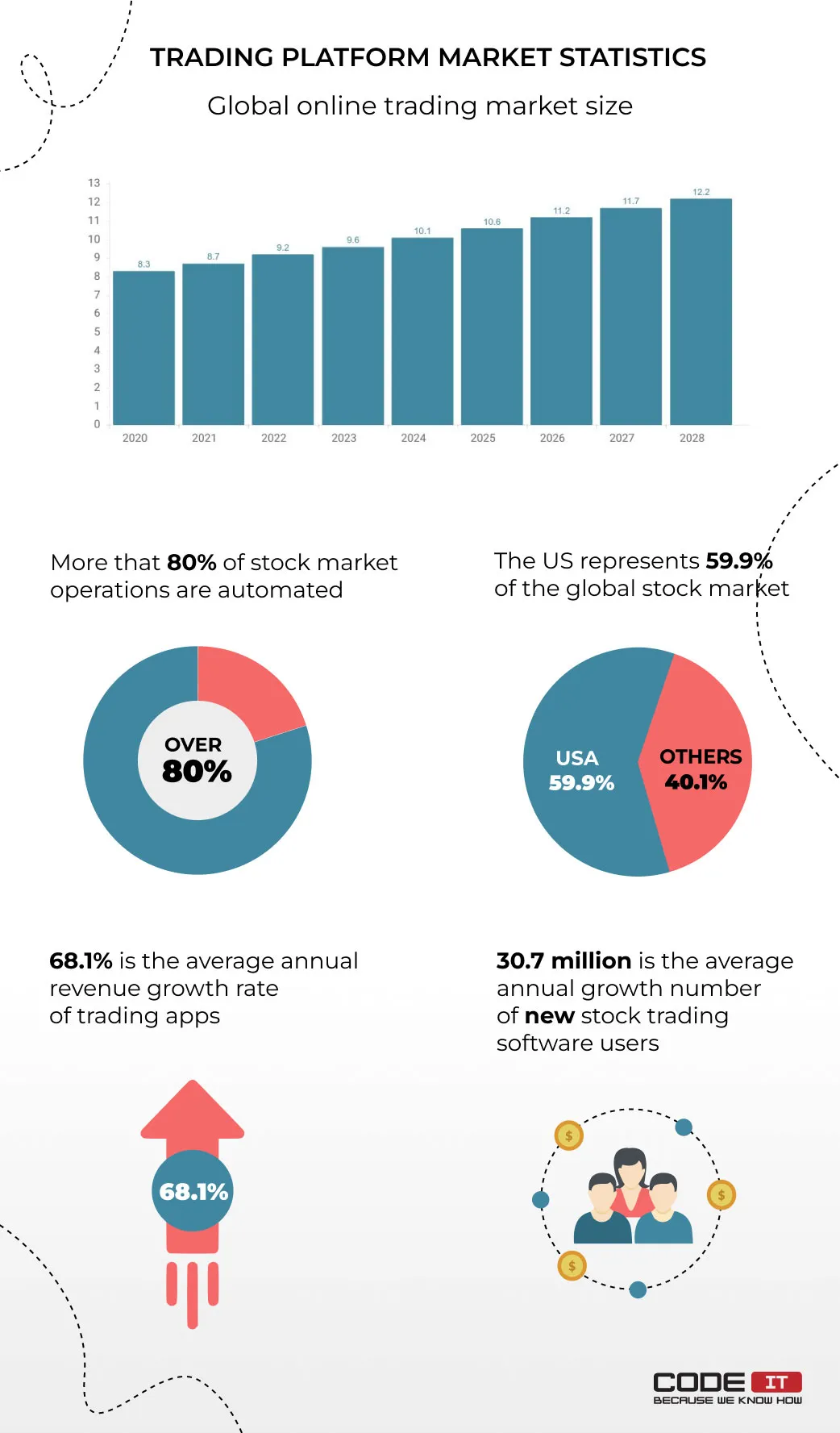

Trading Platform Market Statistics

According to Statista, the global online trading market is growing continuously and will reach the $10 billion mark in 2024. Below, you will find the online trading market growth forecast and fascinating facts.

Codeit Expertise In Trading Platform Development

Finding a reliable partner to delegate trading platform software development is the best solution. At CodeIT, we know how to make your own trading platform and succeed.

We have a large team of skilled software engineers, tried-and-tested workflow, and many successful projects under our belt.

Discover one of the solutions for traders developed by our experts below.

Highly Responsive Dashboard For Traders

It is a feature-rich tool that facilitates trading operations and helps traders improve their performance. The dashboard helps fetch a lot of useful data from various sources in real-time to perform market analysis effectively.

Problem

Our client reached CodeIT, requesting to develop a modern solution to get a competitive advantage over other traders.

Solution

We have thoroughly analyzed the requirements shared by the client and offered the best solution. Our developers have proposed a tech stack and developed the requested solution.

As a result, we have built a comprehensive dashboard that helps track equities, ETFs, and indices on 47 around the globe. The solution analyzes news portals and social media publications to get the latest industry updates.

Also, our software engineers helped the client develop a trading app with prediction calculation algorithms to make data-baked decisions.

Stock Monitoring and Trading Dashboard

SUMMING UP

The trading industry adopts the latest technologies at a high pace. Digital solutions for traders help collect and analyze the required information fast. Moreover, custom-made solutions foresee the opportunity to place orders fast thanks to well-thought-out interfaces.

If you strive to enhance your productivity but don’t know how to create a trading platform, follow the steps below.

- Define goals and validate idea

- Prepare input artifacts

- Create UX/UI design

- Choose a tech stack and APIs

- Onboard developers

- Develop an MVP

- Test your trading app

- Release an MVP

- Upgrade and maintain your trading app

Hiring a skilled expert in creating digital solutions for traders is advisable if you strive to develop a top-tier solution without stress.

FAQ

In order to develop a trading app, you need to do the following:

- Define goals and validate idea

- Prepare input artifacts

- Create UX/UI design

- Choose a tech stack and APIs

- Onboard developers

- Develop an MVP

- Test your trading app

- Release an MVP

- Upgrade and maintain your trading app

An average online trading platform fetches data about stocks, cryptocurrencies, and other assets from different sources using API integrations. It analyzes and arrange fetched data to present it conveniently and share valuable insights.

Nevertheless, there is always space in the room for developing new features. For instance, you can build a trading platform that uses custom algorithms to buy and sell shares of stocks automatically.

There are many ways for trading platforms to make money. However, the most popular monetization strategies are:

- Subscription

- Freemium

- Trade fees

- In-app ads

Don’t you know how to make a trading platform and succeed? Keep in your mind the features mentioned below to develop a top-tier solution.

- Authentication and user profile

- User onboarding

- Newsfeed

- Dashboard

- Secured payments

- Order placement

- Watchlist

- Portfolio

- Notifications

- Analytics

- Algorithmic trading

- Search and filtering

The top trading apps by the number of users are:

- Robinhood

- Cash app

- eToro

- Webull

- Plus500

The top-seven API integrations that can help develop an online platform for trading are:

- Yahoo Finance API

- Alpha Vantage API

- Zirra API

- Twelve Data API

- Alpaca Trading API

- IG Trading API

- Finage API

Cloud computing helps streamline trading platform capabilities. Using a remote server managed by an external vendor, you can automatically adjust the computing power and storage capacity to process large datasets of historical data. Also, it provides top-tier security and high uptime.

Build your ideal

software today