Fintech Software Development Services

Custom fintech software development for banks, financial institutions, and fintech startups. Secure, compliant, and scalable solutions built to support long-term growth.

Business First

Code Next

Let’s talk

- Mobile fintech applications

- Online banking software

- Fraud detection

- Trading platforms

- Generative AI

- Blockchain

- Cloud-based development

- 3rd-party integration

- Insurtech solutions

- Payment gateways

- Accessible platforms for all users

Trusted Fintech Software Development Company

Selecting a fintech software development company is a strategic decision that directly affects regulatory exposure, operational resilience, and customer trust. CodeIT delivers fintech software development services tailored to complex financial ecosystems, strict compliance requirements, and long product lifecycles.

We combine business analysis, secure architecture design, and full-cycle engineering to build fintech software solutions that scale reliably under real transaction loads.

Fintech Software Development Services

Our fintech software development services cover the full product lifecycle — from idea validation to post-launch scaling.

Clarity at the planning stage reduces technical debt and compliance exposure later in the lifecycle.

- Business and regulatory discovery

- Architecture planning and risk assessment

- Technology stack evaluation

Legacy systems often limit innovation and increase compliance risk. Modernization enables controlled transformation without operational disruption.

- Core system refactoring

- Microservices transformation

- API enablement for open banking

- Secure data migration

Long-term stability ensures ROI beyond launch.

- Monitoring and optimization

- Security updates and audits

- Infrastructure scaling

Secure and scalable solutions tailored to transaction logic, user workflows, and performance demands.

- Digital banking platforms

- Payment processing systems

- Investment and trading platforms

- Custom financial software development

- Blockchain and DeFi applications

Fintech products must operate within broader financial ecosystems.

- Banking and payment gateway APIs

- KYC / AML integrations

- CRM, ERP, and accounting systems

- Financial data provider integrations

Develop a custom FinTech platform to meet your evolving business needs.

Business First

Code Next

Let’s talk

AI-driven custom financial software development

Opt for AI-driven software development for financial services to optimize processes and overcome your competitors using innovative solutions. Check out the foremost implementations of AI in finance.

Retrieve financial information, including account balances and transaction details, from our database.

Example: A dynamic financial dashboard that responds to user queries with relevant data.

Aggregate financial data from various sources, getting real-time insights for informed decision-making.

Example: A system assists in providing customized advice to clients, taking into account real-time market data.

Ask financial questions and get answers in natural language.

Example: A chatbot allows customers to quickly access their account information and get financial advice.

Provide personalized financial services by analyzing customers’ preferences, behaviors, and account histories.

Example: An app analyzes how users spend money and invest, and then suggests personalized financial advice.

Quickly find and access relevant documents and instructions of your organization.

Example: A system helps financial analysts find information needed for making investment decisions.

Use a financial knowledge base to respond to financial questions with relevant information.

Example: A virtual chatbot advisor that provides guidance on interest rates and tax benefits.

Access accurate and relevant information from extensive financial knowledge bases.

Example: A system helps quickly find information about financial products, account management, and regulatory compliance.

Who We Work With

Implement the most advanced technologies to deliver exceptional customer experience. Make improved business decisions based on accurate data and relevant insights.

Banks & Financial Institutions

Modernization in regulated financial environments requires balancing innovation with operational stability and compliance continuity.

Business-Critical Capabilities

- Legacy system modernization without disruption

- Digital banking experience enhancement

- Strengthened data governance and audit readiness

- Controlled API enablement and infrastructure upgrades

Fintech Startups & Product Companies

Competitive fintech growth depends on validating products quickly while building architecture capable of long-term scaling.

Operational Priorities

- Rapid MVP development and validation

- Scalable system architecture

- Secure transaction management

- Integration-ready infrastructure

Payment & Financial Service Providers

High-volume transaction platforms require consistent performance, fraud resilience, and secure real-time integrations.

Transformation Focus Areas

- Real-time transaction processing

- Fraud detection and monitoring systems

- High-availability infrastructure

- Secure financial API integrations

CodeIT’s solutions to real-world challenges

Explore real-world case studies where our custom bespoke finance software solutions have made a significant impact.

Data visualization and charting software

The apps fetch real-time data and enable charting features for traders.

- iOS/Android applications

- Real-time data

- Charting and analysis tools

Mobile app for insurance offers

The system automates 90% of the paperwork burden with a CRM integration.

- Personal data auto-filling

- Insurance selection and questionnaire

- Best offers selection and renewal

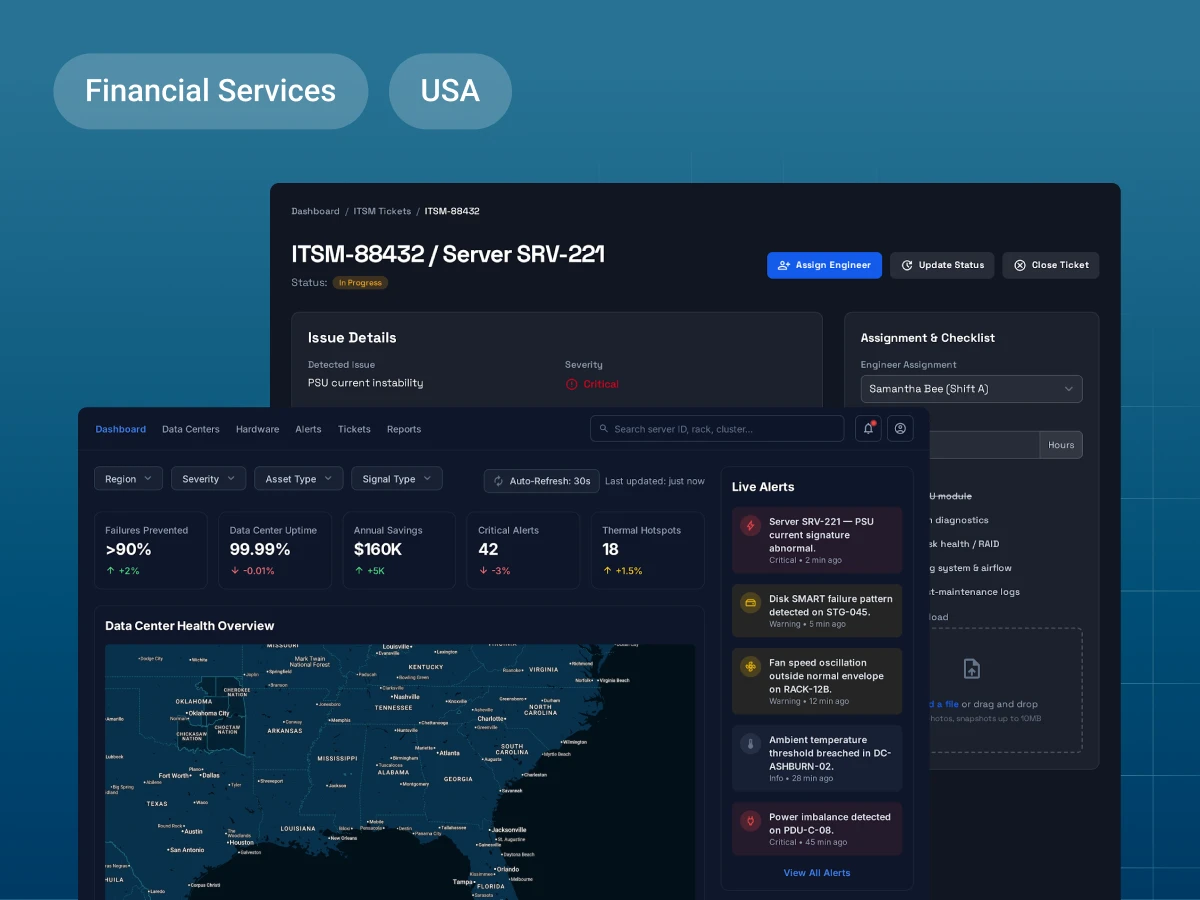

Predictive Maintenance for Data Centers

The predictive maintenance platform virtually eliminated unplanned hardware failures

- >90% Prevention of surprise server failures — fewer incidents

- 99.99% Data center uptime — stronger sla compliance

- 160k USD annual savings — avoided outage costs

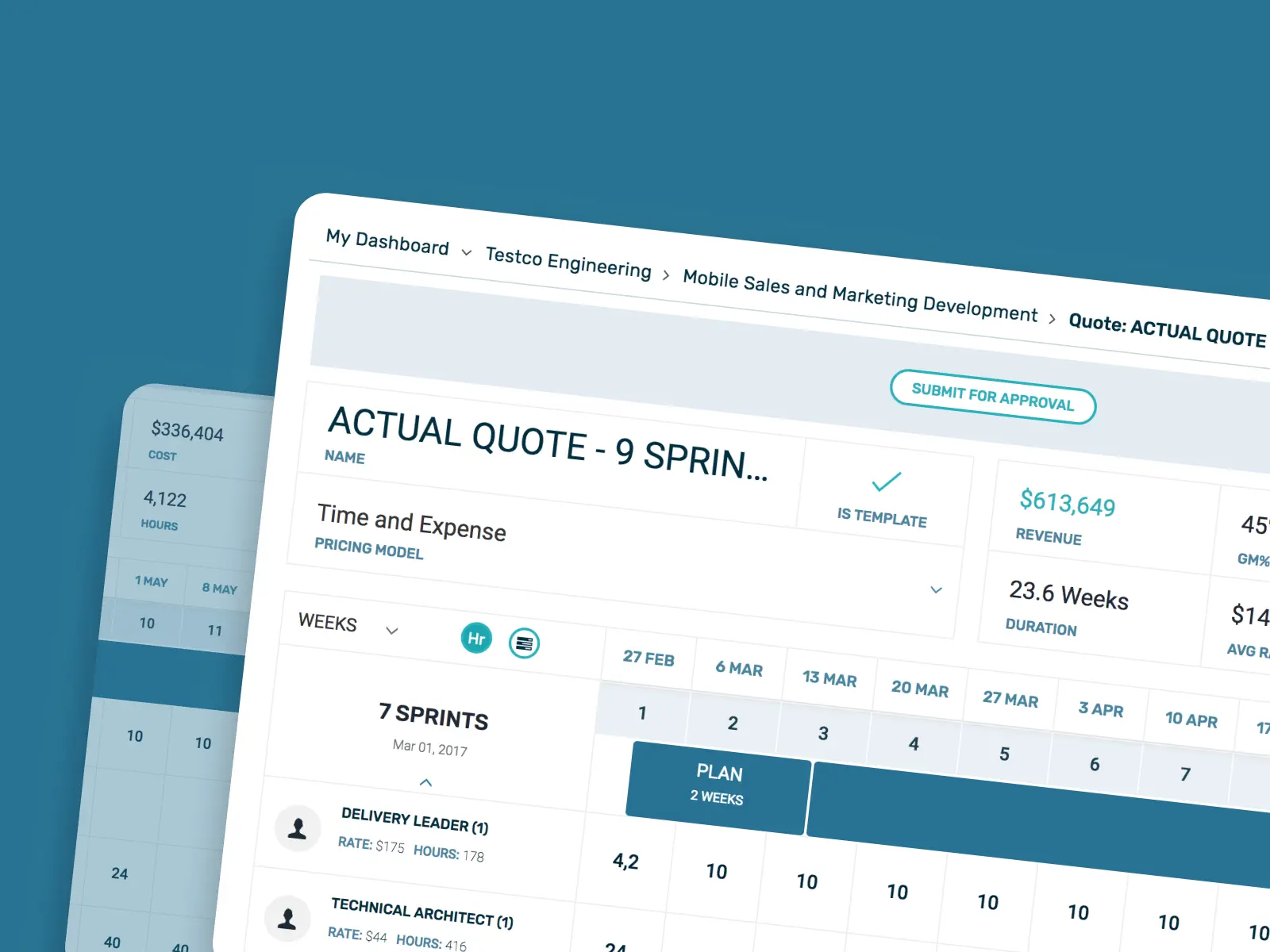

Resource planning & CPQ system

The solution helps traders to monitor stocks in live time on 47 markets.

- Dashboards

- Configure-price-quote system

- CRM integration

Stock monitoring and trading dashboard

The solution helps traders to monitor stocks in live time on 47 markets.

- Real-time updates

- Prices forecasting

- Detailed assets analysis

CRM system for payment processors

The CRM helps manage financial operations and the merchant lifecycle.

- Lead importer system

- Email validation

- Speech recognition

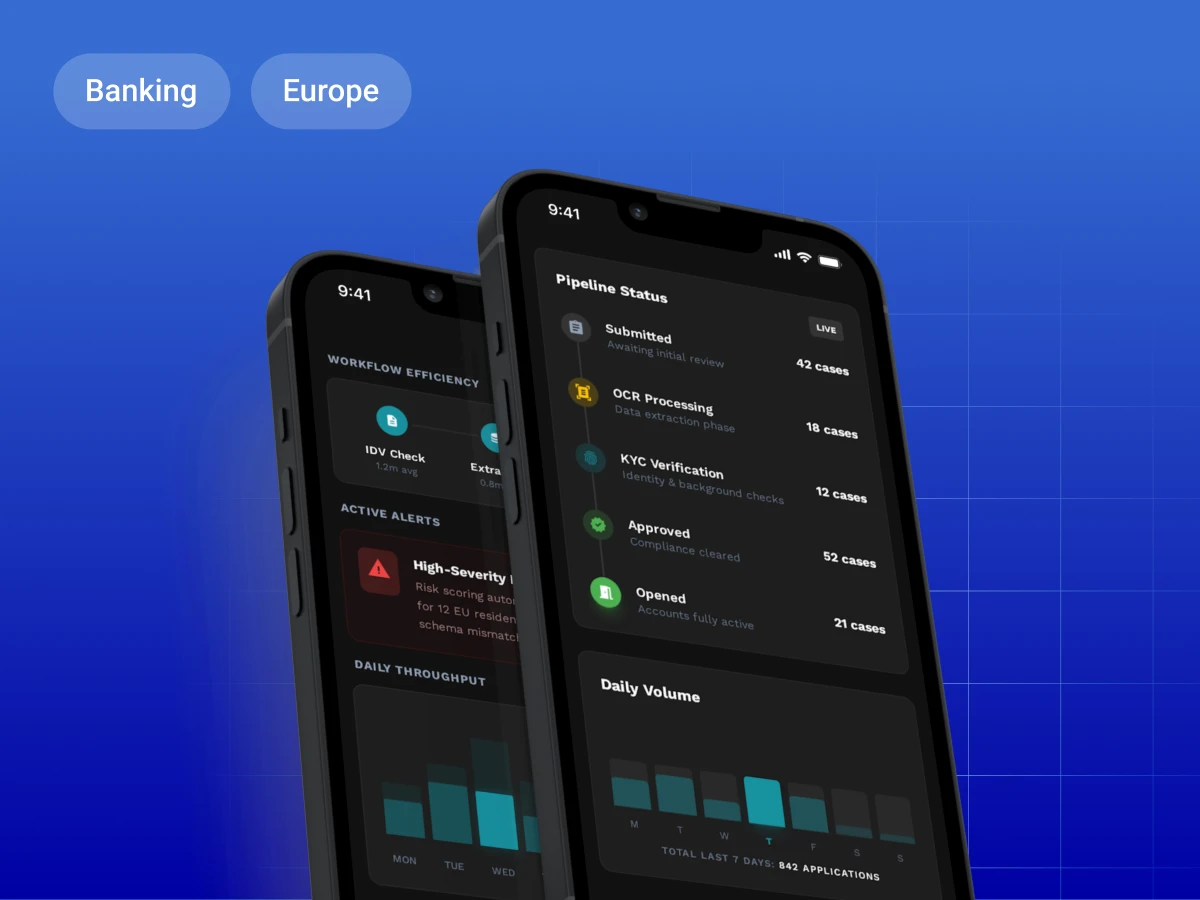

Invoice Processing Automation for Finance Efficiency

A regional bank in Eastern Europe sought to modernize customer onboarding.

- 70%+ onboarding time reduction

- <1 day account opening time

- 0 service downtime

Lay the foundation for your dream financial software.

Business First,

Code Next.

Let’s talk

Why Fintech Teams Choose CodeIT

Built for regulated growth, security, and long-term performance

Business-First Engineering

Successful fintech software development services require alignment with measurable business outcomes. Architectural decisions support operational efficiency, regulatory compliance, and scalable growth. Each initiative is structured to reduce delivery risk while strengthening long-term product performance and financial stability.

Deep Fintech Domain Expertise

Domain expertise strengthens custom fintech software development by improving architectural consistency and minimizing costly rework. Understanding transaction processing, reporting standards, and integration ecosystems ensures financial software development services align with regulatory and operational expectations.

Security & Compliance by Design

In regulated financial ecosystems, security architecture defines viability. Compliance-aware system design reduces audit exposure while maintaining performance and usability across fintech software solutions.

- GDPR-ready architectures

- PCI DSS-aligned payment workflows

- Secure authentication and role-based access control

Predictable Delivery & Transparency

Complex fintech software development initiatives demand structured execution. Milestone-driven planning, transparent reporting, and proactive risk management reduce uncertainty and enable informed stakeholder decisions throughout the delivery lifecycle.

- Defined project phases

- Clear reporting cadence

- Controlled scope governance

How we build financial software

Our financial software development company thoroughly analyzes the needs of clients and delivers the right solutions our clients need to achieve their goals. We always think business before we code.

Discovery & Strategy

A clear roadmap reduces regulatory risk and delivery uncertainty before fintech software development begins. This phase defines priorities, technical constraints, and compliance expectations to ensure fintech software development services align with measurable business outcomes.

- Scope definition and architecture planning

- Business and technical workshops

- Compliance and security assessment

MVP & Prototyping

Early validation protects investment and accelerates time to market. A focused MVP confirms usability, integrations, and product-market fit before scaling custom fintech software development.

- UX/UI prototyping

- Core feature implementation

- Integration and stakeholder feedback testing

Full-Scale Development

Once validated, development scales through structured delivery and secure engineering practices. Performance, compliance, and system stability remain central throughout fintech software development.

- Testing, security, and performance optimization

- Custom fintech software development

- API and third-party integrations

Launch & Scaling

Production deployment marks the transition to operational growth. Ongoing optimization ensures financial software development services remain secure, scalable, and compliant as transaction volumes increase.

- Production deployment and infrastructure setup

- Monitoring and system optimization

- Long-term support and compliance updates

FAQ

Yes, at CodeIT, we can integrate new financial software with your existing systems. We specialize in third-party system integration, ensuring seamless connectivity between different software solutions. This includes integrating payment gateways and external CRM systems and connecting your software to a single database for centralized operations management.

CodeIT’s pricing model for financial sector software development is based on factors such as:

- Project complexity—the size and scope of the project will significantly influence the cost.

- Features and functionalities—the number and complexity of features will affect the development time and resources required.

- Integration requirements—integrating with existing systems may increase the project’s complexity and cost.

We emphasize security as a top priority in our financial software development. Our developers implement robust security measures to protect sensitive financial data, including:

- Encryption—using encryption to protect data both at rest and in transit.

- Multi-factor authentication—requiring multiple forms of verification for access to sensitive information.

- Regular security audits—conducting regular security assessments to identify and address potential vulnerabilities.

- Compliance with regulations—adhering to industry standards and regulations such as GDPR, PCI DSS, and SOX.

At CodeIT, we’re committed to delivering top-tier solutions, emphasizing the following practices to ensure the quality and performance of FinTech software:

- Iterative development—the usage of an iterative approach allows for continuous testing and refinement.

- Rigorous testing—conducting thorough testing throughout the development process to identify and address issues early on.

- Performance optimization—the focus on optimizing software performance to ensure efficient and responsive operation.

- Maintenance—ongoing support and updates help ensure the software remains up-to-date and performs optimally.