Predictive Analytics in Banking

Predictive analytics is a set of activities that help forecast future changes or foresee certain events by analyzing historical records and external data. It helps better understand customer needs, deliver personalized services, and boost sales. Moreover, the data-baked insights help optimize asset management and align with future industry trends.

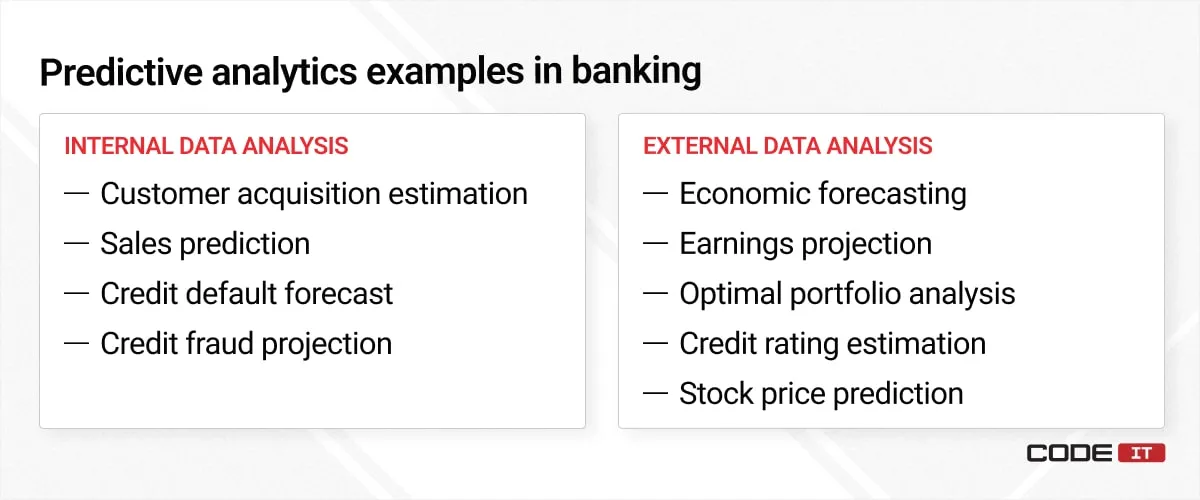

Predictive Analytics Examples In Banking

Predictive analytics can be applied to achieve diverse goals in banking. It enables businesses to gain a wide variety of insights by analyzing data from multiple sources. Let’s review the foremost use cases of predictive analytics in banking, categorized by internal and external datasets.

1. Internal Data Analysis

Internal data may comprise transaction, operational, financial, marketing, and other data. By analyzing internal data, a business can gain unique insights tailored to its organization.

The foremost use cases of predictive analytics based on internal data are:

1.1 Customer acquisition estimation

The analysis of an organization’s data helps predict the outcomes of different customer acquisition strategies. Hence, businesses in the banking industry can pick the most effective ones to increase sales and avoid marketing activities that will likely deliver no positive results.

The internal datasets that can be helpful for predicting customer acquisition outcomes are:

- Historical sales data: purchase history, revenue trends, conversion rates, average order value.

- Marketing campaign data: campaign performance metrics, lead generation data, channel effectiveness, cost per acquisition.

- Customer relationship management (CRM) data: customer demographics, customer journey analytics, product lifetime value data.

- Website and app analytics: traffic data, conversion funnels, user behavior patterns, retention metrics.

- Customer support data: support requests and claims, response times, satisfaction scores.

1.2 Sales prediction

Historical sales data analytics helps predict sales, considering seasonality and future events. Advanced algorithms analyze customer satisfaction and churn rate data to develop custom predictions tailored to a defined business.

The top data types that help predict future trends when analyzed are as follows:

- Historical sales data: transaction records, seasonality trends, growth rates, product sales performance.

- Inventory data: inventory levels, order fulfillment rates, unfulfilled order data.

- Sales team performance: quota records, sales cycle length, deal win rates, meeting metrics.

- Pricing records: historical pricing trends, discount and promotion impact, dynamic pricing models.

- Retention data: repeat purchase rates, loyalty program participation, referral data.

Boost sales with data-backed insights?

1.3 Credit default forecast

Usually, human experts outperform traditional statistical analysis models due to a large number of factors that need to be assessed to predict credit defaults. However, advanced machine learning models are capable of delivering accurate insights and processing large amounts of data from different sources, including the following:

- Customer financial data: payment history, debt-to-income ratio, loan balances, credit utilization.

- Loan-specific records: loan amount, loan tenure, interest rates, repayment schedules.

- Transactional data: bank statements, spending patterns, income consistency, overdraft activity.

- Behavioral data: account activity, loan application history, changes in contact information, early repayment or prepayment behavior.

- Credit history: credit score trends, number of active accounts, default history, delinquency records.

- Internal risk assessment data: risk scores, collateral value, internal risk flags, default probability scores.

1.4 Credit fraud projection

The identification of fraud activities is challenging due to a large number of variables and workflow complexity. Big data analysis and anomaly detection algorithms help identify hidden patterns that human experts may oversee and baseline statistical algorithms cannot detect. The key datasets that help detect credit fraud when analyzed by ML algorithms are:

- Transactional data: Transaction amounts, frequency, locations, refunds, multiple small transactions.

- Account activity data: unusual login patterns, password changes, account lockouts, suspicious account behavior.

- Customer demographic information: mismatch in demographics, unusual personal identifiers, newly registered customers.

- Payment method records: use of multiple payment methods, inconsistent payment patterns, payment method changes, geographical mismatches in payment.

- Fraud and risk alerts: internal fraud flags, previous fraud reports, frequently failed transactions, suspicious account linking.

- Interaction data: communication patterns, inquiries about fraud prevention, claims of unauthorized charges, unusual requests for account information.

2. External Data Analysis

The external data can be captured from customers, vendors, and trusted data providers. It may include historical data changes, survey results, demographic data, public financial information, news, seasonal events, etc.

The top applications of external data predictive analytics are:

2.1 Economic forecasting

It is a high-level analysis of external factors that help understand future trend changes in various industries, countries, and more. Economic estimation depends on an organization’s needs and can involve the analysis of the following indicators:

- Macroeconomic: gross domestic product (GDP), inflation rates, unemployment rates, interest rates.

- Industry-specific: production and output records, commodity prices, retail reports.

- Financial market data: stock market data, currency exchange rates.

- Consumer and demographic metrics: consumer confidence index, population growth, migration data.

2.2 Earnings projection

The development of correlations between historical corporate records and external economic data helps build accurate revenue predictions. Unlike traditional mathematical models, ML-driven ssytems can handle complex computations and pattern identification by analyzing various metrics like these:

- Financial data: revenue trends, profit margins, operating expenses, cash flow statements.

- Sales data: past sales, customer acquisition rates, average order value, product pricing trends.

- Industry and market data: market growth rates, competitive analysis, commodity prices.

- Operational data: production output, inventory levels, employee productivity.

2.3 Optimal portfolio analysis

The goal of using predictive analytics for portfolio management is to identify the best securities to maximize return on investments and minimize risks. Data mining techniques and model evaluation help refine the results. Machine learning algorithms can analyze large amounts of unstructured data from various sources, delivering unique insights. The foremost types of data that can be analyzed are:

- Financial market data: stock prices, commodities prices, exchange rates.

- Economic indicators: GDP growth rates, inflation data, unemployment rates.

- Company data: earnings reports, financial ratios, corporate actions.

- Historical data: portfolio performance, market fluctuations records, correlation analysis.

2.4 Credit rating estimation

ML models are capable of accurately estimating credit scores because they are trained on large amounts of historical data. Early credit scoring helps businesses in the financial industry adjust their customer behavior prediction workflows, offering the best-fitting services and products.

The key data that help analyze credit score ratings include the following:

- Personal financial data: income levels, employment history, debt-to-income ratio.

- Credit history: payment history, length of credit history, number of credit inquiries, credit utilization ratio.

- Account data: active credit accounts, closed accounts, loan types and amounts.

- Behavioral data: spending patterns, savings and investments, financial management habits.

2.5 Stock price prediction

Predictive analytics is widely applied for stock and asset price prediction in long- and short-term horizons. The basic statistical models can forecast price changes by analyzing historical datasets but are limited by restrictive assumptions. Machine learning algorithms can run in-depth analyses of historical data and external data, identifying hidden patterns and correlations for market trends forecasting.

The foremost data types that can be analyzed include the following:

- Historical market data: stock prices, trading volume, candlestick patterns, technical indicators.

- Economic and macroeconomic data: interest rates, inflation rates, GDP growth rates, employment data

- Industry and sector data: industry trends, commodity prices, supply chain dynamics.

- Global events: trade policies, natural disasters.

- Real-time market data: order book data, volatility metrics, option prices.

Benefits Of Predictive Analytics

Implementing predictive analytics in banking helps organizations gain data-driven insights. The analytics outcomes help enable new business opportunities, cut expenses, increase customer satisfaction, and achieve other advantages listed below.

Improved Decision Making

The deep analysis of internal and external data helps financial organizations predict their activities’ outcomes. Machine learning algorithms can analyze large amounts of data, identifying repeating events and hidden patterns that comprise many factors. The reference to data-driven decision-making and data-backed insights helps make informed decisions, minimizing uncertainty and guesswork.

Customer-Centric Services

Predictive analytics helps better understand user preferences and behavior. With detailed insights into customers’ purchasing history, transactional behavior, and industry trends, financial companies can provide tailored services. This personalization approach enhances customer satisfaction as customers can easily access crucial services and receive best-matching offers. Predictive analytics also supports personalized financial services by effectively addressing individual needs.

Increased Sales

Historical data, seasonal events, and market trends can be used to adjust business development strategies. Moreover, predictive modeling and data-backed insights help financial institutions boost their lead nurturing activities. They can launch targeted marketing campaigns and implement customer-tailored retention activities to reduce customer churn rates.

Data-backed insights into customers’ preferences help optimize cross-selling and upselling activities by suggesting the best-matching products/services and improving customer engagement.

Effective Risk Mitigation

Predictive analytics can enable a proactive approach to risk management. Data analysis algorithms can simulate different workflows, identifying overseen risks and bottlenecks. Consequently, banks and financial institutions can fail-proof their strategies, mitigating possible risks before they occur. Predictive analytics can also be applied to fraud detection, credit scoring, and loan delinquency prediction, helping banks secure their operations and maintain financial stability.

Portfolio Optimization

Predictive analytics is a powerful tool for anticipating future trend changes and market price fluctuations. ML-driven algorithms can analyze historical datasets and detect hidden patterns, providing valuable insight into optimizing asset portfolios. They can also improve cash flow forecasting, ensuring efficient fund allocation.

Future Trend Alignment

Keeping up with modern trends is crucial to stay ahead of the competition. Banks that utilize predictive analytics can better understand future trends to adjust their strategies, release new services, and update offers as per emerging customers’ needs. Predictive analytics helps drive cost reductions and supports risk mitigation efforts to align with future challenges.

Challenges In Predictive Analytics Implementation

There is a lack of plug-and-play solutions for predictive analytics, especially when organizations need to analyze large amounts of information from different sources. The key challenges that usually need to be addressed.

Data Preparation and Understanding

Data acquired from different sources usually comes in various formats. All the records need to be cleansed and transformed in advance to achieve high prediction accuracy. Ensuring data quality is essential for achieving reliable analysis outputs.

Moreover, data scientists need to understand the true meaning of data and analysis outputs to adjust predictive models. They also need to address training data limitations and avoid issues such as overfitting, which can reduce models’ generalizability. They need to work closely with financial specialists to understand if certain changes are a significant factor or a regular event that doesn’t significantly impact operations.

Financial Data Sensitivity

Financial providers need to analyze large amounts of sensitive information to obtain accurate forecasts. Consequently, it’s vital to implement robust security measures for data transfer and storage operations in your IT systems. Compliance with GDPR, PCI-DSS, and other data protection standards is critical to ensuring data privacy and security.

The implementation of data anonymization helps ensure that data analysis outputs don’t comprise any personal information of users, maintaining security & compliance with financial regulations.

Data Collection

The continuous analysis of new datasets requires businesses to implement automated data-sharing pipelines to fetch new records from CRM systems, ERP platforms, external databases, etc.

Therefore, financial providers have to implement integrations between systems from different vendors. They also need to enable automated data collection, validation, and transformation tools to always have access to up-to-date information to generate actual insights while maintaining regulatory compliance.

Technical Debt

The foremost technical challenges involve implementing advanced technologies, connecting legacy systems, and identifying data sources. Addressing model performance issues is often necessary to ensure predictions remain accurate and reliable over time. Implementing custom predictive analytics solutions in banking usually requires involving a business analyst, an AI/ML engineer, and software engineers.

Predictive Analytics Models And Techniques

Enabling predictive analytics in the financial industry requires a wide assortment of technologies. Businesses in the financial sector apply tools and techniques that vary depending on their goals and existing datasets.

Model Types

The two types of predictive analytics models are classical and ML-driven. Statistical models can process time series models using certain algorithms and are easy to apply. Machine learning can analyze complex datasets, but training on specific data is needed to deliver accurate results.

1. Classical statistical methods

- Naïve model—a random walk that refers to the values from the same period of the last observed time.

- Exponential smoothing model—the model is capable of adjusting itself by changing the weight of recent data points.

- ARIMA/SARIMA—the models comprise a moving average that helps account for season and repeating events when building forecasts.

- Linear regression method—the model is based on identifying relationships between different variables to calculate values for new data, a key approach in regression models.

2. Machine learning

ML-based algorithms can handle large-scale computations and process unstructured financial data. They can identify hidden patterns, detect anomalies, and adjust in real time. Common techniques include classification models, clustering models, and machine learning decision trees.

Neural networks excel at recognizing suspicious trading patterns and activities such as money laundering and enhancing predictive anomaly detection. However, the benefits of using machine learning only apply if a business is ready to tackle expenses connected to high computation power, large datasets, and the required technical expertise.

Predictive Analytics Tools

There is a wide variety of pre-built solutions that can tackle basic predictive analytics tasks using custom datasets. The top platforms and their best use cases are:

- SAP Analytics Cloud—overal data analysis for trend identification

- SAS Advanced Analytics—powerfull business intelligence tool with predictive analytics functionality

- Alteryx—AI analytics platform with team collaboration capabilities

- Emcien—predcitive analytics solution with advanced tools for marketing specialties

- IBM SPSS—sofware for predictive analytics with rich capabilities for researching

- Ibi WebFOCUS—easy-to-use predictive analytics software for beginners

Predictive Modeling Process

The process of creating a predictive analytics solution in banking depends on business needs, existing solutions, budget, and other factors. The key steps of predictive modeling are:

- Business objectives understanding

- Data collection and preparation

- Training/testing data splitting

- Model selection and implementation

- Model testing and output validation

- Model tunning

- Deployment and scaling

Predictive analytics in banking is evolving at a high pace, adjusting to the evolving needs of businesses in the financial sector with the following core trends.

Low-Code/No-Code Solutions

The rapid development of low-code/no-code predictive analytics systems makes it easy for non-tech users to gain insights from their datasets. Generative AI development streamlines no-code development, using the technology’s capability to generate SQL code by submitting requests in natural language.

These tools, powered by AI & analytics engines, lower the barrier for businesses to adopt predictive analytics. Moreover, they decrease the dependency on data science expertise for businesses that implement predictive analytics.

Real-Time Analytics

The fast-changing environment in the financial services industry needs businesses to leverage real-time insights. Hence, fintech providers demand data-sharing pipelines and automated predictive analytics workflows to get real-time insights. Also, it helps financial institutions to rapidly respond to dynamic market conditions.

Increased Data Governance Control

The high accuracy of predictive models can be achieved through the analysis of vast datasets, raising the scale of data mining activities. It makes governments and regulatory organizations raise concerns about the personal data of clients processed by banks. Therefore, more regulatory requirements are expected to appear to ensure ethical AI practices.

CONCLUSION

Predictive analytics helps organizations in the financial sector to make informed decisions. The foremost applications using external and internal datasets include the following:

- Customer acquisition estimation

- Sales prediction

- Credit default forecast

- Credit fraud projection

- Economic forecasting

- Earnings projection

- Optimal portfolio analysis

- Credit rating estimation

- Stock price prediction

Leveraging the outcomes of predictive analytics, businesses can boost sales, increase customer engagement, detect fraud, identify risks, and deliver customer-centric services. Being informed about future trend changes, they can effectively adjust their business development strategies to overcome competitors.

FAQ

Predictive analytics refers to the use of data analysis to forecast future changes or predict specific events by leveraging historical records and external datasets. This practice enables banks to better understand customer needs, deliver personalized services, and optimize asset management. The data-driven insights also align banking strategies with future industry trends.

Predictive analytics is applied in various banking scenarios using internal and external data.

Internal data analysis

- Customer acquisition estimation—predicts outcomes of acquisition strategies by analyzing sales, marketing, and customer behavior data.

- Sales prediction—utilizes historical sales and inventory data to forecast future sales trends, considering seasonality and customer churn rates.

- Credit default forecast—machine learning models analyze financial and behavioral data to predict credit risks.

- Credit fraud projection—identifies fraudulent activities using patterns from transactional and account activity data.

- Economic forecasting—analyzes macroeconomic indicators, industry-specific data, and financial market trends to predict economic changes.

- Earnings projection—builds accurate revenue predictions by correlating corporate records with external economic data.

- Optimal portfolio analysis—helps manage investment portfolios by analyzing market, economic, and historical performance data.

- Credit rating estimation—predicts credit scores by analyzing financial history, account data, and behavioral metrics.

- Stock price prediction—forecasts asset prices through advanced analysis of market, economic, and real-time data.

External data analysis

- Customer acquisition estimation—predicts outcomes of acquisition strategies by analyzing sales, marketing, and customer behavior data.

- Sales prediction—utilizes historical sales and inventory data to forecast future sales trends, considering seasonality and customer churn rates.

- Credit default forecast—machine learning models analyze financial and behavioral data to predict credit risks.

- Credit fraud projection—identifies fraudulent activities using patterns from transactional and account activity data.

- Economic forecasting—analyzes macroeconomic indicators, industry-specific data, and financial market trends to predict economic changes.

- Earnings projection—builds accurate revenue predictions by correlating corporate records with external economic data.

- Optimal portfolio analysis—helps manage investment portfolios by analyzing market, economic, and historical performance data.

- Credit rating estimation—predicts credit scores by analyzing financial history, account data, and behavioral metrics.

- Stock price prediction—forecasts asset prices through advanced analysis of market, economic, and real-time data.

Predictive analytics delivers data-baked insights, providing the following benefits:

- Improved decision making—provides data-driven insights to minimize guesswork and improve strategic decisions.

- Customer-centric services—enhances personalization based on customer behavior and preferences.

- Increased sales—boosts marketing efficiency and retention activities through targeted campaigns and tailored offers.

- Effective risk mitigation—identifies potential risks and bottlenecks through proactive analysis.

- Portfolio optimization—anticipates market trends and asset price fluctuations for better investment strategies.

- Future trend alignment—keeps banks ahead of competition by identifying and aligning with emerging trends.

The foremost steps of predictive model creation and implementation are:

- Data preparation and understanding—cleansing and transforming data from diverse sources into usable formats.

- Model selection—choosing between classical statistical methods (e.g., regression analysis) and machine learning models based on goals and data complexity.

- Data analysis—applying algorithms to identify patterns, trends, and correlations in data.

- Validation and testing—evaluating model performance to ensure accuracy and reliability.

- Deployment and monitoring—implementing the model into operational workflows and continuously monitoring its performance for updates and improvements.

Build your ideal

software today