Generative AI in Banking

The usage of generative AI in finance and banking helps businesses automate bothersome operations and streamline workflows. Moreover, the implication of AI in investment analysis for banks helps extract valuable insights by detecting hidden patterns.

AI in wealth management solutions helps overcome traditional software thanks to rich capabilities in data analysis, segmentation, summarization, personalization, and more. Below, read about the applications of generative AI in banking and the benefits the technology delivers.

The top advantages of using gen AI in banking in numbers are:

- 15x increase in loan approvals is achieved on average with AI-driven tools

- 20% of costs can be cut by enabling AI automation

- 90% reduction in fraudulent activities is achieved using generative AI in financial services

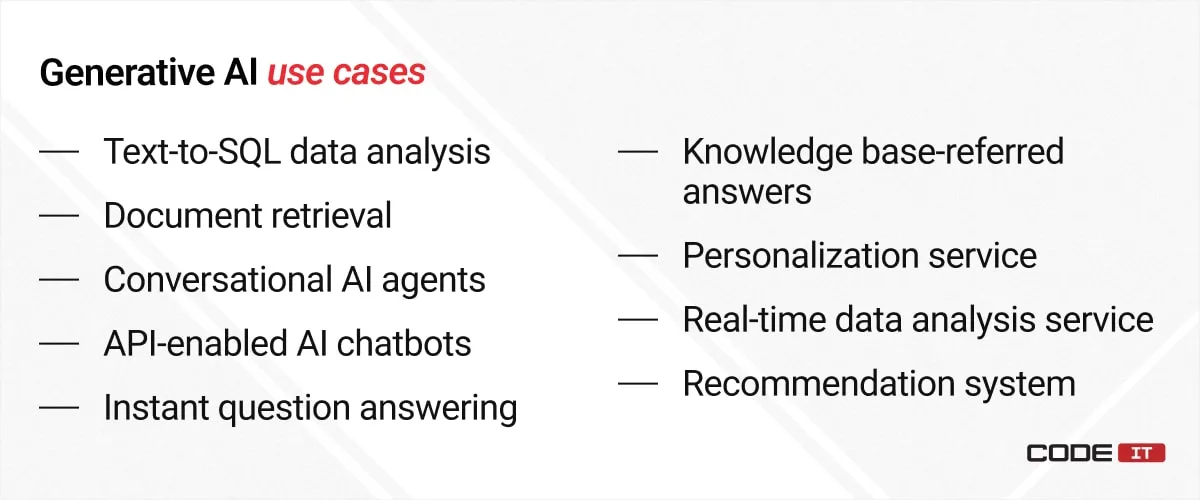

Generative AI Use Cases In Banking

Financial institutions most commonly use generative AI in the form of AI agents that provide personalized customer service, user-specific answers, and valuable insights from vast amounts of data.

The foremost generative AI in banking use cases are as follows.

1. Text-to-SQL Data Analysis

This feature enables the opportunity for users to pull out any data and run comprehensive data analysis without the need to involve specialists with the knowledge of SQL. An AI agent can interpret requests submitted using natural language into SQL code and execute it. As a result, it can deliver the requested information from a database or compose a custom report.

Example: Using natural language, a user asks an AI chatbot to provide information about new clients over 30 years in the last week. The tool understands the intent and translates it into the SQL code that is being executed. Once the query is completed, the requested information is provided to the user in the form of a spreadsheet.

Develop a custom tool for conversational analytics

Business First

Code Next

Let’s talk

2. Document Retrieval

The technology helps streamline documentation management, eliminating the need for team members to waste their time exploring knowledge bases. Having all the internal documentation indexed, the generative AI can instantly provide access to relevant documents with the instructions a user needs.

Example: A custom AI-driven system assists financial analysts in gathering information for investment decisions. It finds and provides links to all the documents relevant to a case described by a user. The tool can also provide summarized information to boost financial analysts’ performance.

3. Conversational AI Agents

It helps automate customer interactions by developing a custom AI chatbot that simultaneously handles many real-time conversations with different users. Being connected with an organization’s databases, the AI chatbot can answer clients’ questions by providing accurate account details or personalized recommendations.

Example: An AI chatbot provides real-time assistance to the clients of a financial services provider. The chatbot has access to a user’s account details to provide personalized answers and recommendations.

4. API-Enabled AI Chatbots

An AI agent fetches real-time financial data from multiple sources using API integrations. It helps facilitate real-time insights and decision-making for both customers and financial professionals.

Example: An AI-driven system leverages API integrations to gather real-time financial data to assist investment advisors in providing tailored advice to clients based on up-to-date information.

5. Instant Question Answering

A custom tool helps customers and financial advisors by providing accurate answers by pulling data from trusted sources. It eliminates the need for users to spend a lot of time finding the right documentation and extracting the right answers to specific questions.

Example: A virtual financial advisor powered by generative AI answers questions about interest rates or tax benefits, referring to only information from a corporate database.

6. Knowledge Base-Referred Answers

AI systems in finance and banking utilize extensive financial knowledge bases to provide accurate and relevant information, enhancing decision-making and operational efficiency for analysts, advisors, and clients.

Example: An AI agent empowers customer service representatives, enabling rapid access to information on financial products, account management, regulatory compliance, etc. Consequently, they can provide accurate and prompt support for customers.

7. Personalization Service

The use of generative AI in the banking and finance industry helps organizations analyze vast amounts of data. The insights they obtain are useful for providing personalized services and offers to each customer based on factors like individual preferences, behaviors, account histories, and more.

Example: An AI banking app analyzes user behavior, including spending trends and investment interests, to offer bespoke financial recommendations. It can provide advice on customer-tailored savings strategies or investment options that align with individual goals.

8. Real-Time Data Analysis

This application of generative AI in banking describes the technology’s ability to retrieve and analyze real-time datasets like market data or stock prices. AI chatbots provide up-to-date responses based on the recent data received and analyzed.

Example: A trading platform with integrated generative AI that retrieves real-time data from multiple sources and provides stock market analysis and suggestions. Moreover, it can tackle sentiment analysis by checking recent news and social media publications in bulk.

9. Recommendation System

Personalized banking with AI is described as customer-tailored investment advice based on user financial data. An AI-driven system can analyze a lot of structured and unstructured data, detecting hidden patterns. The insights extracted are useful for proving best-matching recommendations that are backed by specific user data.

Example: A system recommends stock portfolios or loan products that are tailored to a user’s financial history.

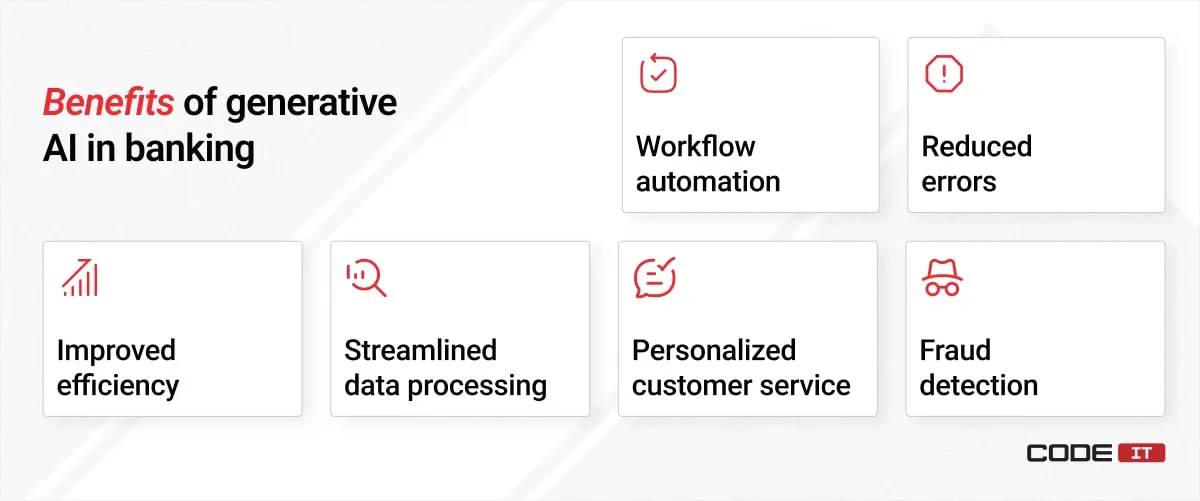

Benefits Of Generative AI In Banking

AI-powered banking solutions help organizations streamline their processes, automate bothersome tasks, and run effective documentation management.

Workflow Automation

The implementation of AI agents, connected with third-party solutions, enables companies to automate activities. It eliminates the need for banking experts to manually explore internal systems looking for customers’ data, certain instructions, financial data, etc.

Financial experts can submit requests using natural language to get actionable queries and retrieve relevant insights or documents. Moreover, it enables businesses to automate customer service, employee guidance, reporting, and other crucial activities.

Supporting statistics:

- 15x is the average increase in loan approval with AI-driven tools

- 20% of costs can be cut with the help of AI automation

- 862 million hours of working time AI tools help solve in the banking industry annually

Reduced Errors

The application of AI in banking operations reduces the manual input that translates into reduced human error. Moreover, AI tools provide effective and data-baked guidance to financial advisors and banking workers. They can instantly get relevant information from verified sources by asking questions in a free form. It helps improve decision making and eliminate guesswork because of instant access to any information that needs clarification.

Supporting statistics:

- 67% is the average decrease in error rate after implementing AI-enabled systems

- 30% of credit losses can be decreased with AI-driven credit risk management

- 90% decrease in fraudulent activities is achieved with generative AI in financial services

Improved Efficiency

The automation of bothersome and time-consuming tasks helps businesses to make their experts focus on the most essential and revenue-generating tasks. Moreover, the utilization of AI in investment analysis for banks helps streamline processes by providing experts with accurate insights and recommendations in real time.

Supporting statistics:

- 22% is the projected cost optimization by AI-driven tools in the next five years

- 45% is the highest operational efficiency increase achieved

- 50% is the average productivity increase in front-office operations operations

Streamlined Data Processing

Generative AI tools with API integration can fetch financial data from multiple sources. They can analyze structured and unstructured data, extracting insights from vast datasets. AI-driven tools can process information from internal databases, market feeds, user queries, and more in real time. Furthermore, they can provide summarized information and generate custom reports upon a user’s demand.

Supporting statistics:

- 2x increase in loan processing time through AI-enabled tool usage

- 50% increase in customer lifetime value can be attained with AI-based recommendations

Personalized Customer Service

AI-driven customer service in banking is described by chatbots that can provide instant assistance to multiple customers in real time. They can understand the intent of questions and provide user-tailored answers.

Deep analysis of customer behaviors, preferences, and transaction histories helps AI virtual assistants offer best-matching services. For instance, personalized marketing can help users pick tailored savings plans based on a customer’s spending habits and financial goals.

Supporting statistics:

- 80% and more of customer inquiries can be resolved by AI chatbots

- 20% increase in cross-selling is achieved thanks to personalized customer experience

Fraud Detection

AI in banking cybersecurity helps organizations to continuously monitor data and detect suspicious activity, identifying anomalies or patterns indicative of fraud. For example, an AI-powered platform evaluates loan applications by analyzing applicant data and credit histories, resulting in faster and more reliable approvals. Moreover, the technology’s capability to detect unusual patterns spreads across unstructured data.

Supporting statistics:

- 95% accuracy in fraud detection was achieved by using AI tools

- $30 billion saved annually because of using generative AI for fraud detection

Hire CodeIT to access AI development expertise

Business First

Code Next

Let’s talk

Real-life Generative AI Examples In Banking

The real-life generative AI in banking use cases comprise the technology utilization for solving different challenges. It helps companies to automate operations, provide personalized service, and gain competitive advantage with data-driven insights.

Morgan Stanley

The investment bank has released custom AI tools that empower its financial advisors. The suite of GenAI tools helps advisors streamline their performance by:

- handling all the notetaking during conversations

- summarizes conversations and outlines action points

- composes email drafts, considering the past communications and future plans

98% of the company’s financial advisors have already adopted the AI solution. They share positive feedback, highlighting the tool’s ability to help them avoid wasting time on bothersome tasks and engage with clients more efficiently.

Mastercard

The payment processing company uses generative AI for fraud detection and automated customer assistance. The AI protection tool helps quickly uncover suspicious card activity, enhancing cardholders’ security and maintaining the financial system’s integrity.

The other generative AI applications in banking helps the company quickly onboard new clients. An AI-driven chatbot answers clients’ questions, guides them through the new account setup process, and helps resolve unforeseen issues.

Royal Bank of Canada

The financial institution uses technology to analyze large amounts of data and enable financial report automation. It has developed an AI-enabled electronic trading platform that makes informed, data-baked decisions. The trading platform can analyze real-time data and quickly adjust its trading strategies to achieve maximum profitability.

OCBC Bank

The integration of ChatGPT into the bank’s chatbot helps its employees run financial analysis, product planning, and marketing initiatives in a more efficient way. The custom AI chatbot keeps all the data entered by employees secured, as it is not shared with OpenAI.

The large language model is deployed on the company’s servers. The AI virtual assistant has helped the company’s employees to increase their performance by 50% so that they can dedicate more time to higher-value tasks.

Wells Fargo

This financial service provider uses the power of generative AI in credit risk assessment and cost optimization. The company also uses the technology to enable personalized user expertise by offering customer-specific services that AI algorithms find the most useful for each client individually.

Wells Fargo has implemented built-in protection measures to avoid any discrimination that may occur when AI algorithms process client data. They have also enabled each client to connect with a human agent to resolve their issues with the help of a real person.

How Generative AI Banking Is Transforming Future

Generative AI in the banking and finance industry enables businesses to optimize and automate their processes. The technology completely transforms traditional banking workflows, enabling specialists to allocate their time to more valuable tasks.

The foremost trends in generative AI development in the banking industry are as follows.

1. Generative AI is Top Trend

The feasible benefits of implementing generative AI in banking make companies adopt the technology quickly. Businesses in the financial sector strive to stay ahead of the competition and optimize their workflows. Top companies in the financial sector leverage AI to optimize their marketing campaigns and enable conversational analytics.

2. AI Attracts Funding

Statistics say the application of generative AI in banking is a magnet for investors. The research conducted by Deutsche Bank highlights the fact that projects that implement AI solutions get higher valuations at every stage.

- Seed: 21% more

- Series A: 39% more

- Series B: 59% more

The trend defines the future of generative AI in banking, making it highly available as a new tool for finance advisors, traders, and other specialists.

3. More Regulations Will Arise

Political anxiety over the fast-paced growth of generative AI has led governments worldwide to introduce stricter data management and AI usage regulations. Moreover, the use of AI for user assessment may lead to possible discrimination based on factors that algorithms define. Hence, financial institutions need to develop discrimination-free policies and expect more regulations to appear.

Final Words

Generative AI in banking unlocks vast opportunities for employee performance optimization and bothersome task automation. Moreover, it provides data-baked insights and enables personalized customer service.

The top use cases of generative AI in banking are:

- Text-to-SQL data analysis—converts natural language queries into SQL code for instant data retrieval and custom reporting.

- Document retrieval—instantly indexes and fetches relevant internal documents to streamline knowledge management.

- Conversational AI agents—automate customer interactions with chatbots that provide real-time, personalized responses.

- API-enabled AI chatbot—integrates with APIs to deliver real-time insights and data for informed decision-making.

- Instant question answering—quickly provides precise answers by extracting information from trusted databases.

- Knowledge base-referenced answers—enhances operational efficiency by delivering accurate insights from extensive knowledge bases.

- Personalization service—analyzes user behavior to offer tailored services and recommendations based on individual preferences.

- Real-time data analysis—retrieves and processes live data for up-to-the-minute insights and suggestions.

- Recommendation system—provides data-driven recommendations for products or services customized to user profiles.

FAQ

The most widespread use applications of generative AI in banking are as follows:

- Text-to-SQL data analysis

- Document retrieval

- Conversational AI agents

- API-enabled AI chatbots

- Instant question answering

- Knowledge base answers

- Personalization services

- Real-time data analysis

- Recommendation systems

The foremost benefits of gen AI in banking include:

- Workflow automation—cuts costs by 20%, automate tasks, and reduces human effort

- Error reduction—decreases error rates by 67% and credit losses by 30%

- Improved efficiency—boosts productivity by 50% and operational efficiency by 45%

- Streamlined data processing—analyzes vast datasets for real-time insights

- Personalized customer service—resolves 80% of inquiries with tailored responses

- Fraud detection—achieves 95% accuracy in fraud detection, saving $30 billion annually

The three top trends of implementing generative AI in the financial sector are:

- Adoption growth—financial institutions rapidly integrate AI to stay competitive

- Increased investment—AI attracts higher funding across all investment stages

- Regulation expansion—governments introduce stricter AI and data management rules

Five financial companies that leverage the strengths of generative AI capabilities are:

- Morgan Stanley—AI tools streamline financial advisor tasks like notetaking and email drafting.

- Mastercard—AI enhances fraud detection and customer onboarding.

- Royal Bank of Canada—uses AI-driven trading platforms to make data-informed decisions.

- OCBC Bank—deploys ChatGPT-based chatbots for financial analysis and planning.

- Wells Fargo—implements AI for risk management and personalized client services.

Build your ideal

software today