Machine Learning for Stock Prediction

Machine learning is a technology that helps answer questions by processing data. It helps unleash insights hidden in raw data. Developers can create and train models that give results to specific inquiries, including image detection, spelling error correction, forecasting, etc.

In the article below, you will learn how to use machine learning to forecast stock price changes in the future.

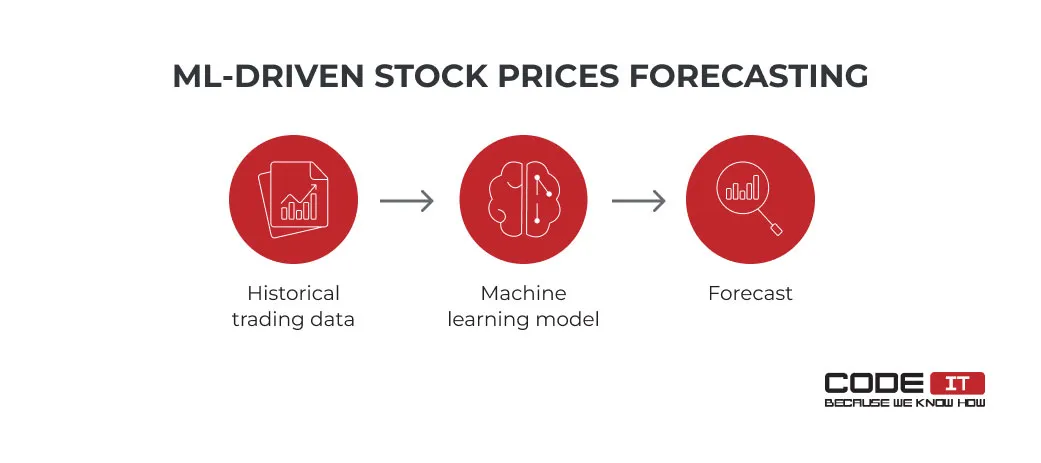

Machine Learning For Stock Prices Forecasting

The application of machine learning for stock prediction defines the processes of using ML algorithms for analyzing historical trading data to forecast new values.

Unlike traditional programming, developers don’t need hard-type algorithms that cover different cases to predict new values by analyzing historical trading data. Machine learning algorithms analyze data to define patterns that help forecast stock prices.

The end result of machine learning stock market prediction is a model. It takes raw datasets, processes them, and delivers insights. ML models can self-improve to enhance the accuracy of delivered results through training. Once trained, machine learning models can use diverse data from various sources to deliver answers.

Many companies widely adopt machine learning for stock prediction. For instance, Sentient Technologies is a famous AI company that uses ML-driven technologies to analyze data and predict stock prices. Below, you will find more information about real-world machine-learning applications for stock prediction.

Classical Time Series Analysis Vs Machine Learning

Traders use many tools, algorithms, and statistical models to predict stock prices, trends, trading volume, etc. Let’s learn more about mathematical models to forecast time series values and ML algorithms.

Classical time series analysis models use algorithms to predict new values, considering observed data. These models can be applied by using spreadsheets and mathematical formulas.

These methods for stock prediction based on fundamental analysis are good at analyzing observed data to generate predictions using defined algorithms. However, they can hardly adjust fast, spot anomalies, or predict possible trend changes.

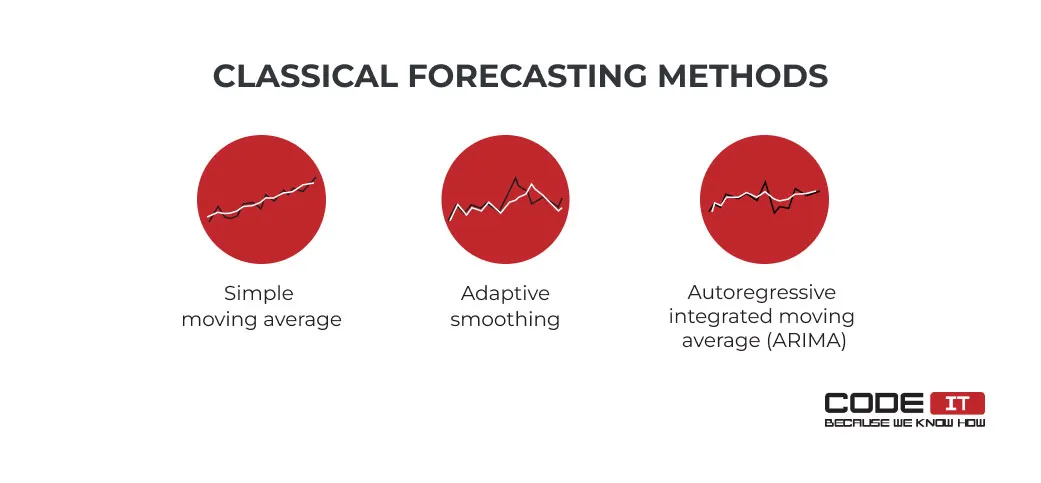

The most popular classical time series forecasting methods are the following.

- Simple moving average. The most simple model calculates the constant mean of observed values to calculate predicted stock prices.

- Adaptive smoothing. The model uses a variable that can be adjusted, considering the error between actual and predicted prices.

- Autoregressive integrated moving average (ARIMA). The model helps generate predictions by calculating differences between observed stock prices.

Most classical models for forecasting time series are simple and don’t need a lot of computation power. However, they cannot forecast trend changes or get adjusted with a delay. Classical methods can be applied to forecasting events that repeat regularly.

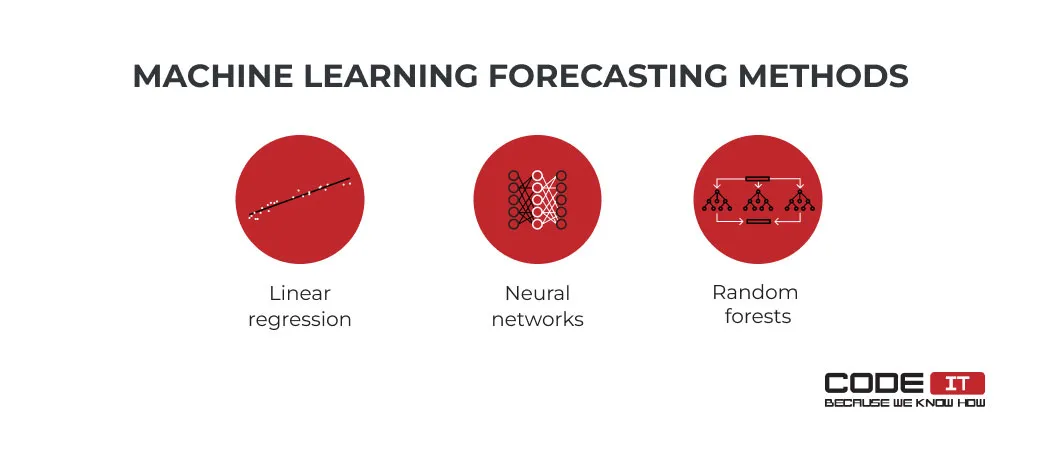

Machine learning algorithms are used to develop and train models that help predict stock prices. Machine learning stock prediction models are more sophisticated than classical statistical methods. Also, they can assess many factors and spot patterns. The three most popular ML models are as follows.

- Linear regression. It is a simple ML model that is aimed at identifying the most optimal relationship between dependent and independent variables. When trained, a model delivers a linear function that helps predict future values.

- Neural networks. It is a sophisticated deep learning technology that can adjust itself when comparing forecasted and actual values to deliver accurate machine learning stock predictions. A neural network has input, output, and hidden layers that imply nodes. Simply put, every node can be considered a distinctive linear regression model. All the nodes are connected and have weights, known as coefficients, that adjust during the training process.

- Random forests. It is a method that analyzes the results of multiple decision trees. Since random forests can process a lot of data, they are good at handling datasets that imply many variables.

Below, you will find a brief comparison of classical statistical analysis and machine learning for stock prediction.

| Classical Methods | Machine Learning Methods | |

|---|---|---|

| Complexity | Usually, classical statistical models have the form of mathematical formulas. | Complicated models that imply a lot of parameters and adjusted connections between them. |

| Training | A small amount of observed data is required to develop predictions. | ML models need vast amounts of training data. Also, it may be required to spend a lot of man-hours in the case of observed training. |

| Accuracy | Can accurately predict repeating events and short-term changes. | Can deliver comprehensive data-baked forecasts, considering nonlinear dependencies between parameters. |

| Computing Power Requirements | A small amount of computing power is needed to analyze historical trading data. | Vast computation capabilities are needed to train models, especially when they imply a lot of parameters. |

| Flexibility and Scalability | A classic time series analysis model can hardly be scaled or changed due to solid mathematical rules. | ML models can be scaled thanks to parallel processing. Also, they can be easily adjusted. |

| Technical Expertise Requirements | Basic mathematical skills are required to apply formulas. Also, users may need to have programming skills to automate data processing. | ML stock prediction expertise and Python skills are required to pick the best model for predicting stock prices and implement it. |

In essence, using machine learning methods is a more advanced way to make stock price predictions using machine learning. They can process a large number of data, spot patterns, and deliver accurate forecasts, considering many factors.

How To Use Machine Learning To Predict Stock Prices

In order to start using machine learning to predict stock prices, you need data, developers, data scientists, and willingness to take a plunge into the technology.

Roles To Involve

There is no out-of-the-box solution for stock market prediction using machine learning. To develop and train a custom model, you need to gather a team of tech specialists with relevant domain expertise.

The roles that can be involved in an ML project are as follows.

| Role | Responsibilies |

|---|---|

| Data Scientist | ML models selection, engineering, training, and assessment. |

| Data Engineer | Data collection, storage, evaluation, and transformation. |

| Software Developer | ML-driven app development, machine learning models integration using API. |

| Machine Learning Engineer | Machine learning models development, cloud or on-premises infrastructure establishment. |

Large ML teams are usually involved by big tech companies that need to research and forge innovations.

Most startup teams consist of data engineers and software developers with the required domain expertise.

If you don’t have access to software engineers and tech experts with domain expertise, you can outsource machine learning app development to an experienced professional.

Technologies To Use

The stock market prediction using machine learning projects must collect, process, and store vast amounts of data. Also, it’s required to develop ML models and applications for end-users.

The foremost technologies required to create an ML-driven application for predictive stock price analytics are the following.

Programming language

Python is the most popular programming language that is used in AI and ML projects thanks to a wide range of frameworks and libraries. The other two popular programming languages used in ML projects are Java and R.

Data storage and processing

An on-premises or cloud infrastructure is required to store and analyze collected data. MySQL, PostgreSQL, and Apache Cassandra are among the most popular technologies used for storing vast amounts of data.

Machine learning libraries

Libraries are pre-built algorithms and tools that software engineers use to develop ML models faster. According to the StackOverflow survey, the top ML libraries are Pandas, TensorFlow, Keras, and PyTorch.

Looking for tech-strong machine learning engineers to hire?

Business First

Code Next

Let’s talk

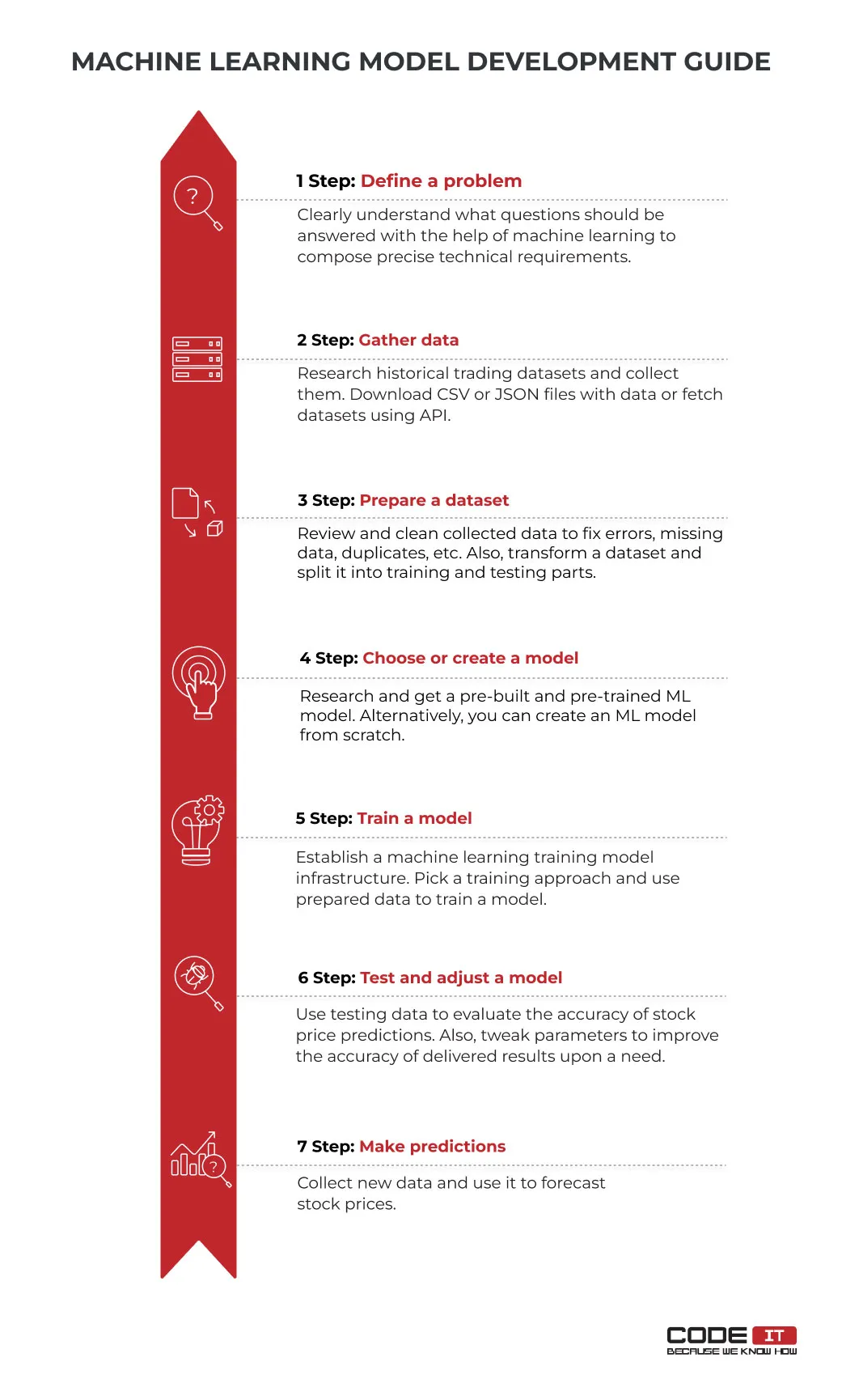

Machine Learning Model Development Guide

Begin the development of a model to use machine learning for stock prediction by following the seven steps specified in the post below.

1. Define a problem

First of all, it’s essential to clearly define the goals you want to achieve by adopting machine learning. Try to understand if there is a real need to use ML models to get accurate predictions or if they can be developed using classical mathematical models.

Create questions that should be answered by a machine learning stock prediction model and define data types you can access and analyze. An ML engineer should define features to analyze to create a well-tailored model to predict stock prices.

Also, it’s essential to define the final goal of your project. For instance, if you want to develop an ML-driven trading platform, you have to specify all project requirements to build the solution you need, avoiding a large number of change requests.

2. Gather data

The quality and amount of data used to train and test stock market prediction machine learning models affect the predictions’ accuracy.

Understand what data you must collect and find sources to scrap historical trading values. Datasets can be accessed via API or downloaded as JSON or CSV files. Some popular stock market datasets are:

Many other platforms can be used for fetching historical trading data. Access to datasets may be free or paid. You can use multiple sources to collect various datasets.

3. Prepare a dataset

The quality of data used for training affects the accuracy of the results of a model. Therefore, a data science expert should prepare a dataset by conducting the following activities to use machine learning for stock prediction.

- Review. Analyze datasets and pick crucial parameters only to optimize data processing.

- Cleaning. Check all the data to detect and fix errors, missing data, improper data formats, duplicates, and other errors.

- Transformation. It is a vital part of data preprocessing that helps transform a dataset into the best format for further use through normalization, scaling, hierarchy generation, etc.

- Splitting. Various data should be used for training and testing. Therefore, it’s necessary to split the prepared dataset into two parts. Usually, training data takes ¾, while testing data takes a ¼ part of the entire dataset.

4. Choose or create a model

The developers should create a new machine-learning model from starch, considering your requirements and collected data.

To speed up the model development process, you can use a pre-built stock market prediction machine learning model and adjust it to your needs. Some popular resources to get built and pre-trained machine learning models are:

5. Train a model

Machine learning stock prediction model training is a time-consuming process requiring much computing power. Vast data should be analyzed iteratively through the training process to achieve the best accuracy in forecasting stock prices.

The most efficient way to allocate a lot of computing resources for ML model training is using cloud servers. The most popular providers are:

- Amazon Web Services: Machine Learning

- Google Cloud: AI and Machine Learning

- Azure: Machine Learning as a Service

There are two major ways to train an ML model:

- Supervised learning. A machine learning model analyzes labeled data. It analyzes features of entered data to define relationships between input and output information.

- Unsupervised learning. Unlabeled data is provided to an ML model. It should analyze to define patterns or similarities and classify all the information processed. Unsupervised learning is widely used for classification tasks.

Supervised learning is the best option for machine learning stock prediction. It is more accurate and efficient. However, unsupervised learning can help define hidden patterns, detect unusual activity, etc.

An involved specialist with domain expertise has to choose the best machine learning method, considering the data you have and the goals you want to achieve.

Hire CodeIT’s specialists to develop an ML model!

Business First

Code Next

Let’s talk

6. Test and adjust a model

Use the test part of your dataset to evaluate the accuracy of predictions that a trained model provides. It’s vital to use a dataset that wasn’t involved in the training process to discover how a model performs when analyzing data it hasn’t seen before.

In case the accuracy of predictions is poor, software engineers need to adjust some parameters, including training sets, learning rate, and other parameters, to achieve better accuracy.

7. Make predictions

Once you train your model to deliver accurate predictions on stock price changes, you use it in real-world trading, like many successful companies already do.

Besides, involved software engineers can develop software that visualizes received trading forecasts to deliver them in a user-friendly way, like TensorBoard.

Build ML-driven software to forecast stock price changes!

Business First

Code Next

Let’s talk

Real-world Examples

Many companies succeeded in stock trading, risk management, and other activities thanks to artificial intelligence and machine learning. Let’s learn more about the top ones.

| Company Name | Company Type | Machine Learning Application |

|---|---|---|

| Sentient Technologies | Artificial intelligence technology company | Artificial intelligence and machine learning models are used to generate thorough stock price predictions to get revenues through trading. |

| BlackRock | Investment company | ML and AI are widely applied by the company, including fraud detection and natural language processing. The foremost applications of machine learning for the company are risk assessment and market trend prediction. |

| Numerai | AI-run hedge fund | The company uses ML-driven stock price predictions to optimize trading strategies and minimize risks. |

Challenges Of Machine Learning Stock Price Prediction

Even though machine learning is an advanced technology, it can hardly develop 100% accurate and error-free stock price forecasts.

For example, according to the research conducted by Machine Learning Mastery, classical mathematical models can outperform basic and poorly-trained ML models.

Poor Accuracy

Many factors affect the accuracy of stock market predictions. Some ML models can have poor accuracy because of insufficient information analysis. Therefore, there is always a high risk of developing machine learning stock prediction models that don’t deliver breakthrough stock price forecasts.

Unexpected Changes

The growth or fall of stock market prices can be predicted by defining and analyzing patterns. However, the market is highly unpredictable because it depends on unexpected global events, news, chairman announcements, etc. Unexpected events that don’t fall into any patterns or correlations cannot be predicted, hence taken into account to develop forecasts.

Stock price prediction models can be tricked by simply quote-tweeting an influencer’s post on Twitter and altering a word or two.

Cost and Complexity

The development of an error-proof ML model that delivers highly-accurate predictions should be trained well by using large amounts of top-quality data. The process of dataset preparation and intensive model training needs to spend a lot of time and computing power, which causes high development costs.

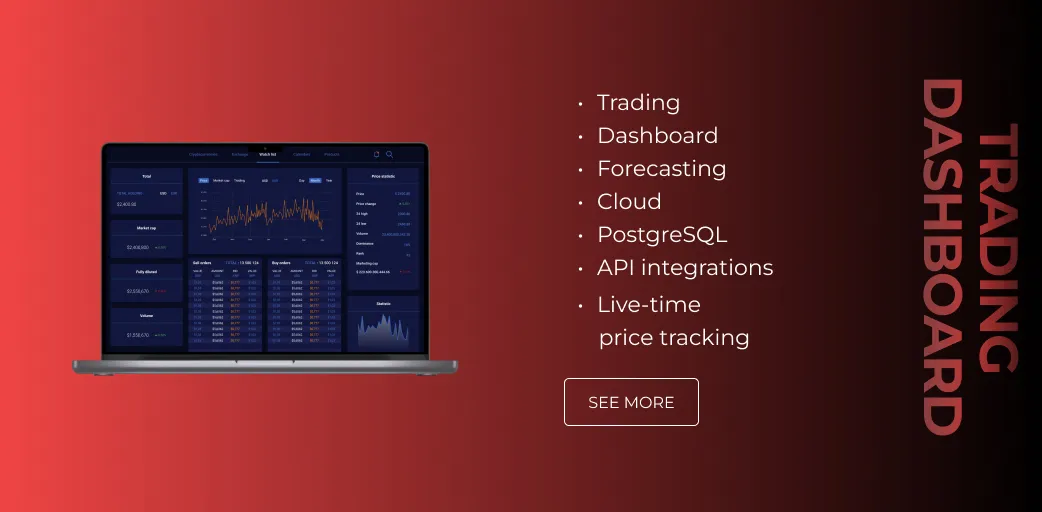

Ml-Driven Trading Solution — CodeIT Expertise

The CodeIT team developed an advanced solution for traders. It enables access to the most useful tools in one place.

Problem

The client strived to increase the performance of traders by developing a new solution from scratch. It was designed to replace many diverse systems that traders usually use. Also, the team was requested to implement an ML-driven data analysis functionality to make data-driven decisions.

Solution

We’ve defined all the features to develop and created a thorough solution development plan. CodeIT’s software engineers have developed a web app that enables access to many useful features for traders over the Internet.

- Detailed assets analysis

- Real-time updates

- Historical trading data

- Price change forecasting

- News and social media monitoring

- Several workspaces

- Portfolio management

- Combined indicators

Discover how the one-stop system works in more detail by reading the case study.

Wrapping Up

The use of machine learning for stock prediction helps define dependencies between variables and hidden patterns. Machine learning models help traders reduce risks and make better sales decisions based on insights extracted from historical trading data.

The development of a machine learning model for trading implies the following stages:

1. Problem definition

2. Data gathering

3. Dataset preparation

4. Model selection or creation

5. Model training

6. Model testing and adjustment

7. Trading predictions

In order to develop a model that delivers accurate predictions, it’s necessary to use a lot of training data of top quality. The more data is used for model training, the better predictions it will deliver.

FAQ

Yes. Machine learning techniques for stock prediction are widely used to forecast price changes, spot patterns, or detect anomaly activity to improve trading strategies.

There are no solid requirements on the number of tech experts that should be involved in developing an ML-driven stock prediction software. Usually, it’s necessary to involve the following roles:

- data scientist

- data engineer

- software developer

- machine learning engineer

There is no 100%-accurate and error-free ML model. These days, there is a wide assortment of pre-built and pre-trained stock price prediction machine learning models that can predict prices. Also, you can develop a new ML model from starch and train it using various datasets. The better data is used for training, the better results a model can deliver.

The process of developing a new model that uses machine learning for stock prediction implies six steps that are the following.

- Define a problem

- Gather data

- Prepare a dataset

- Choose and create a model

- Train a model

- Test and adjust a model

Stock prices can be predicted using mathematical methods like:

- Simple moving average

- Adaptive smoothing

- Autoregressive integrated moving average (ARIMA)

Using a machine learning stock prediction model is a more sophisticated way to predict stock prices. Machine learning can process a lot of historical data to detect connections between variables and hidden patterns to predict price changes more accurately.

Build your ideal

software today