Digital transformation in banking: why it requires implementation?

The digital transformation process is not been something new for a long time, no matter what industry we are talking about. In truth, the rapid technological development, as well as the incredible pace of the Internet adoption as the main means of communication and trade in the early 2000s, created conditions in which any business simply needs to go digital if they want to maintain their presence in the market, continue to compete and provide its users with a quality service.

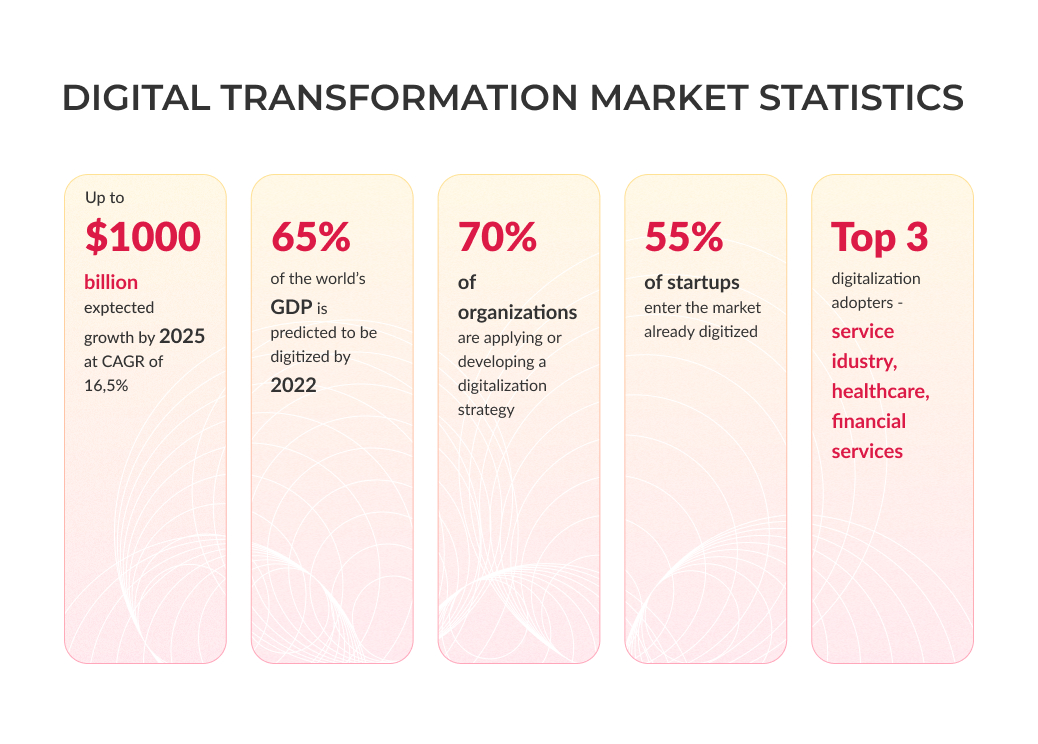

Of course, today even a medium-sized business having its own website or even a mobile application isn’t coming as a surprise. This is not surprising if you look at the pace at which the digital transformation process is developing today. According to some studies, the expected growth of the digital transformation market will reach $1,009.8 billion by 2025 at a CAGR of 16.5%. If these figures are not enough, then it is worth looking at others in order to make sure that the lack of digital banking innovation process will be disastrous for the vast majority of businesses – 65% of the world’s GDP is predicted to be digitized by 2022. In addition, 70% of organizations are applying or developing a digitalization strategy today, while over 55% of startups are entering the market already digitalized.

These figures are extremely convincing, but there are still rare niche products, the issue of digitalization of which is not yet on the agenda as urgently as with other industries such as the financial sector, services industry, and healthcare. We will talk about the state of the digital transformation in banking in this article.

What is digital transformation in banking?

First things first. We start by defining what the digital transformation process in banking is. Many people, hearing the phrase “digital transformation” immediately imagine a conventional bank that develops its website and mobile applications, switching to providing its services remotely via smartphones, minimizing paperwork and bureaucracy. It is important to understand that in the banking industry, digital transformation implies not just a transition to newer equipment and the creation of digital products for the bank, but a complete revision of the entire corporate culture, customer service, and all related approaches.

As with many other industries, digital innovation in banking sector began around the second half of the 2000s. The economic crisis of 2008 hit hard on the digital opportunities of the banking sector. On the other hand, the same crisis made it clear to the representatives of the industry that the transition to digital space can become the key to the more successful handling of such crises. Further development of mobile services and technologies, as well as global interest in the Internet of Things approach, have dotted the I’s, making the digitalization of the banking sector and the emergence of the FinTech industry inevitable.

So, in addition to the obvious investment in creating new digital banking innovation ideas for placing your bank in a digital space, such as a mobile application or website, the digital transformation process in banking also includes a complete rethinking of the strategy of doing business and providing fintech solutions. The transition to digital implies the creation and implementation of a complete customer-oriented strategy in the bank. The task of the bank is to minimize the difficulties for the customer, including automating most of the processes, simplifying the receipt of various services, eliminating paperwork, and minimizing the touch of the customer to the bureaucracy. In the end, what is the point for a customer from the fact that the bank has gone digital if his personal User Experience with such a bank did not benefit from this, right?

Ultimately, the same good old customer retention strategies remain the goals of digital innovation in banking. An increase in the percentage of customer retention allows banks to achieve an almost 30% reduction in the cost of attracting new customers and increase their profit by more than 80% in a two-year period.

Now, let’s talk about the key points of the digital transformation process in banking.

YOUR GUIDE TO STARTING A FINTECH COMPANY

Crucial points of digital transformation in banking

Of course, the digital transformation process in banking does not happen suddenly and overnight. This is a fairly long-term strategy that should be well thought out, since digital transformation affects all processes of the bank, from operational activities to new problems related to the correct storage of data and security. In general, the most important elements of digital transformation in banking are:

Customer experience. Improving customer experience and custom interaction are the main goals of digital transformation in banking. Automation of routine processes and maximum limitation of the user from bureaucracy has a positive effect on the customer experience and allows you to build new and longer-term relationships. The bank becomes open in order to provide its services 24/7, on a completely remote basis, while undertaking to securely store the personal data of customers. A deeper understanding of user needs, which is also the impact of digital transformation in banking, allows you to build better marketing strategies and provide more customized services.

Organizational activity. The transition to digital space means fundamental changes in the bank’s operations. Thus, significant changes are being made to the organizational structure regarding the means of communication with customers, the creation of a system for electronic storage of data and the exchange of information, and the creation of means of protecting this data.

All parties benefit from such a transition: the bank gets new opportunities in communicating with customers and providing its services; customers get a more custom service and get rid of paperwork. Digitalization also means creating an effective mitigation strategy that will generally improve the design process and budget allocation for various tasks. Virtualization of the bank’s workflow allows for a convenient process of interaction between clients and the bank, with the collection of digital data available to all parties for study and analysis.

Top management readiness. More than 70% of digital transformation processes fail, according to a 2020 study by the Boston Consulting Group. This is primarily due to the lack of faith in the final result of this event on the part of the top management and the lack of a clear understanding of why and for what the digital transformation is being carried out. Often, the decision to start a digital transformation is made in view of the objective numbers and trends that we talked about above. At the same time, little attention is paid to a specific case with a specific bank and what metrics should be taken into account when launching such a process in this case.

The will of the bank’s top management in such a situation can save the digital transformation from failure. Agreeing to the understandable risk and understanding the importance of rethinking all processes in favor of a more custom-tailored approach is a key factor in the success of digital innovation in banking.

Advantages and disadvantages of digital transformation in banking

Obviously, any process has the opposite effect. An unsuccessful digital transformation can lead to serious losses and complete bank closure in the worst scenario. Despite the many advantages that digital transformation offers, this process has its drawbacks and risks.

Digital transformation drawbacks, risks & challenges

We start with the risks, challenges, and disadvantages of digital transformation in the banking sector.

Investments. It all depends on specific cases, but most often digital transformation requires significant investments, both monetary and time. Choosing the right digital transformation services provider, the discovery phase, analyzing competitors and their strategies, working out your own strategy, not to mention the development, design, testing, and support of the whole ecosystem of new digital products. When embarking on a digital transformation, a bank must be ready to invest large resources.

Security issues. Going into the digital space, the bank must be ready to allocate resources to create a separate team that will ensure that user data is stored in accordance with all the conditions of the regulator, whether it be the GDPR or something else, and their protection is reliable. In any business where money and its storage are concerned, the attention of users grows in geometric progression, as does the attention from scammers. A bank that is going to be digitalized must take this factor into account and spare no resources to provide reliable security measures.

Lack of a well-thought-out digitalization strategy. We have already touched on this issue above: the bank risks losing a lot of money and never achieving the set result and any advantages if the digitalization strategy was not carefully thought out and planned. Ideally, this process should be overseen by a separately hired experienced manager, most often represented by the genus Digital Transformation Director. This person will be responsible for ensuring that the digitalization process proceeds according to the plan, the risks will be handled on time, and the process itself will take place step by step with a predictable result.

Digitization, not digitalization. Yes, these are two different concepts that are often confused. This is due to the fact that digitization is the process of creating some kind of digital product with the absence of fundamental changes in the corporate culture and organizational structure, which we talked about above. Digitalization, in turn, implies just that. Lack of understanding that digital product creation is not enough to complete a successful digital transformation process can also lead to unsatisfactory results.

Lack of understanding between the bank and the software vendor. For a successful digital transformation process, a bank needs to achieve full interaction between its IT team and representatives of the IT software vendor, who will be directly involved in the development of innovative digital banking solutions. Lack of mutual understanding can lead to serious consequences in the form of a final product that will not meet the initial requirements and will be incomprehensible to the bank’s IT team. In addition, there is a risk of choosing not a high-quality software vendor, and the process of selecting the necessary specialists can take months and entail additional costs and risks.

Digital transformation advantages

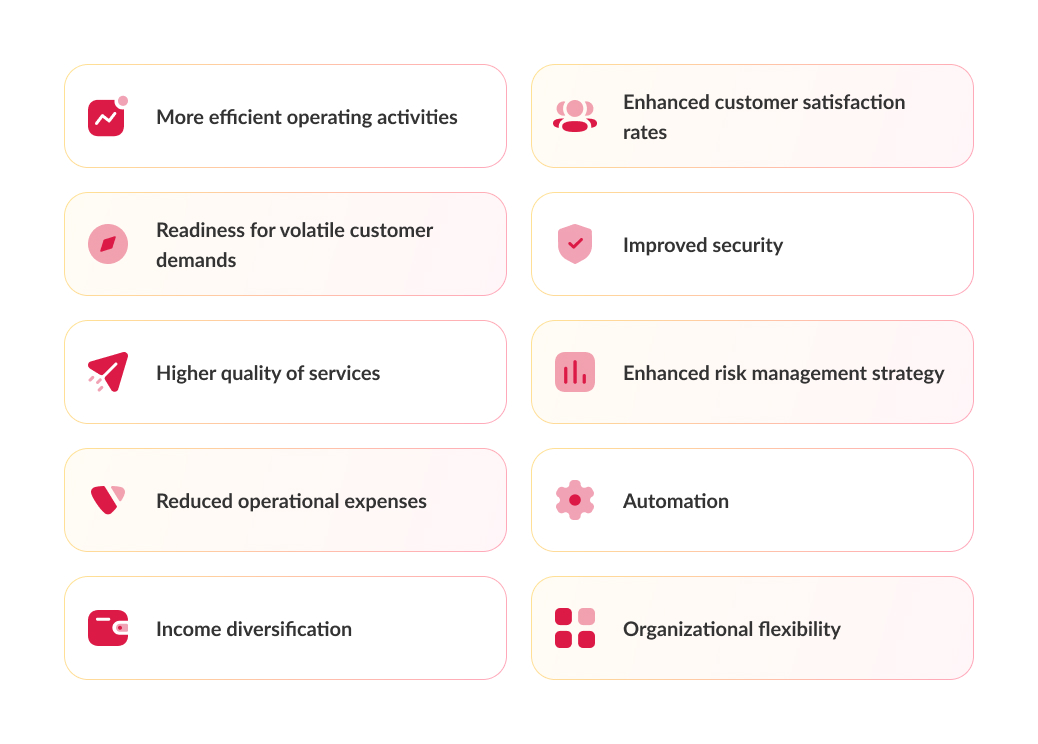

Despite the obvious challenges and risks associated with digital transformation in banking, the benefits that can be obtained in the end overcome any doubts of stakeholders.

More efficient operating activities. In the digital space, it is easy to ensure more efficient operational activities, thanks to the automation of some processes, simplification of communication between specialists and customizers, and the creation of an understandable workflow.

Readiness for volatile customer demands. One of the essential traits that any modern business, including banks, must possess, is readiness and flexibility in relation to the changing and increasing demands of the customers. The very fact of bringing benefit from any business in modern conditions is no longer enough. What is now also important is the speed and convenience with which benefits are provided, as well as the bank’s willingness to quickly adapt to the introduction of new technologies, be it new means of authentication using biometrics or anything else. Digital transformation is a big step towards preparing the bank for such challenges.

Higher quality of services. Of course, offline services are not going anywhere in the banking industry, and some clients, especially elite representatives of big business, will still prefer offline meetings at some points. Nevertheless, the digitalization of the processes can significantly improve the overall quality of the services provided by the bank, from simplifications for the customers to the provision of a complete no-human service.

Reduced operational expenses. Automation and digitization of workflows allow reducing operating costs and reduce overall costs for internal processes.

Income diversification. Moving into the digital space, the bank is faced not only with new opportunities to spend money but also with new opportunities to earn it. So, the bank can start earning from new digital contracts and partnership agreements, as well as in the mobile application.

Enhanced customer satisfaction rates. Successful completion of the digital transformation process will inevitably entail higher customer satisfaction rates, thanks to all the benefits they will receive.

Improved security. In the offline space, the security of data storage is limited by the physical safety of the hard drive and servers. Moving to the digital space, many banks give preference to remote and reliable cloud providers, which allows them to qualitatively improve the security of their users’ data storage.

Enhanced risk management strategy. As we said above, one of the important factors in the development of a digital transformation process is the creation of a risk management strategy, the task of which will be to minimize the possible risks associated with the transformation. The same approach will be carried out after the completion of the transformation since the digital ecosphere of any bank implies a risk mitigation strategy associated with the preservation of user data.

Automation. Everything is simple here – automating routine tasks is always good. This frees up time for professionals to perform more complex and creative tasks and to give more attention to customer care activities.

Organizational flexibility. Digitalization implies the creation of such conditions for the bank when the entire organizational structure can become more flexible and scalable.

Examples of digital transformation in banking

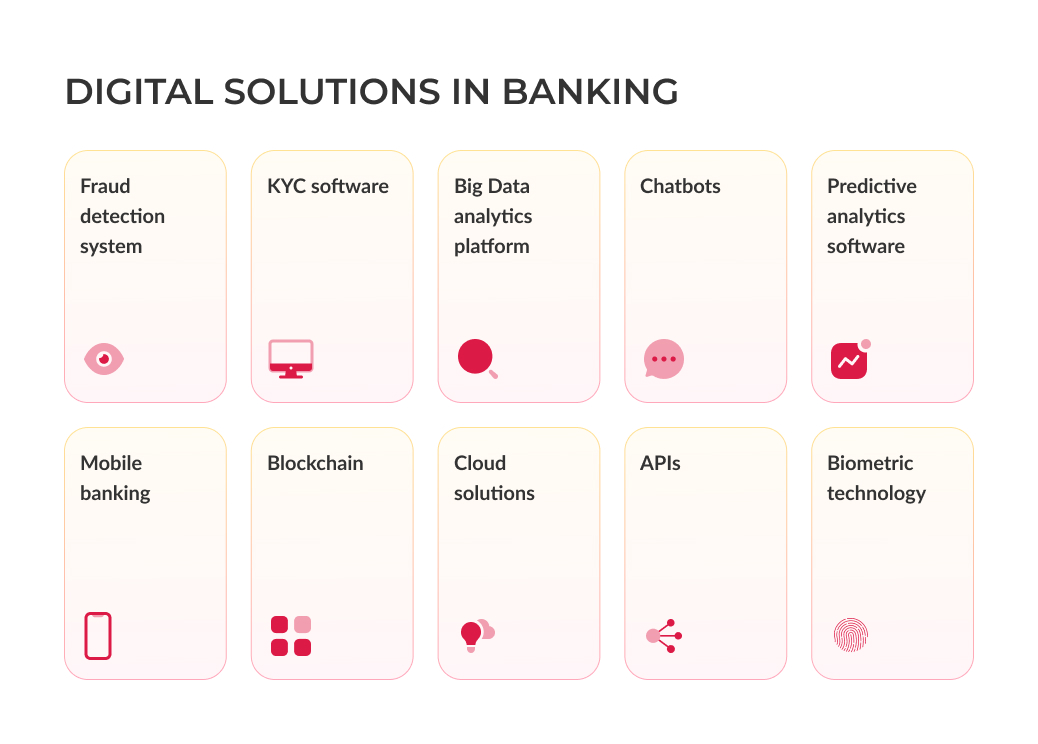

It’s time to talk about specific examples of solutions that result from the process of digital transformation in banking.

Fraud detection system

As a result of the digital transformation process, a bank can gather a Data Scientist team to create a machine learning-based fraud detection system. The key task of such a system will be to track possible fraud, which means that it is worth training the system on the largest possible number of different data input streams. Thanks to the subsurface fraud detection system, representatives of the banking sector can significantly increase the quality of fraudulent actions detecting.

KYC software

Know your customer software is one of the key factors in attracting banks to the digital transformation process. Such software helps to identify customers and stay within the framework of current legislation, for example, the Patriot Act. This law requires banks to verify the identities of their customers in order to combat money laundering and counter-terrorism. In countries such as the United States, Know Your Customer initiative is a must, but in the digital space, such software is the most convenient mean of customer identification.

Big Data analytics platform

Without a doubt, due to their importance, banking institutions are the place where a huge amount of data is collected. The next stage in the development of a banking service can be reached by those banks that can quickly and efficiently analyze all this data for a better understanding of the pains of their customers and create more custom offers. In addition, Big Data analysis also improves the overall bank security and marketing activity.

Chatbots

Yes, you won’t surprise anyone with chatbots today, but if you doubt that they are the future, think again. One of the main problems of offline banking is a long wait for a response from bank representatives and a long exchange of information even in the most simple questions. After all, there is a fixed working day. Moving to digital, every bank should definitely think about how to create a convenient and learning chatbot for its online audience. Ideally, a chatbot should handle 80% of user requests, and in the remaining 20% send their requests to a customer care specialist.

Predictive analytics software

Predictive analytics in banking derives from Big Data opportunities. Thanks to machine learning-powered analysis of large amounts of data, it becomes possible to predict future events and avoid the associated risks. So, predictive analytics in banking is associated with such frequent activities as Cross-Sell and Upsell, customer retention, account transaction management, fraud detection, cash & liquidity planning, and others.

Mobile banking

One of the main opportunities that digital transformation gives. Mobile banking is the most convenient way to receive and provide banking services today. By using hardware on custom devices, you can increase the number of innovative banking features provided, as well as introduce biometric authentication through a camera or fingerprint. Finally, everyone uses banking applications today and this is simply a must for any bank that goes digital. The banking app is definitely one of the current trends in mobile app development segment.

Blockchain

Cryptocurrencies can come and go, but the blockchain technology behind them will stay with us for a long time. This technology is the quintessence of crypto-encryption and distributed data storage, which is becoming more and more popular. Cryptocurrencies are accepted for payment in more and more places and even the largest banks are giving up and starting to provide services in the sector. Digital transformation does not oblige the bank to also touch the blockchain segment, but this can be a good investment for the future.

Cloud solutions

Someone goes to the cloud for the sake of increasing security, someone for the sake of freeing up time for their IT teams, and someone for the speed and flexibility that the transition to Cloud gives. In any case, banks today are facing enormous pressure and competition, and only those banks that will work quickly and smoothly will acquire their new customers. Cloud solutions are available for digital banking representatives in the form of a large number of cloud vendors.

APIs

Another important factor, which is often forgotten, but which helps a modern bank to squeeze out in a competitive digital environment, is the bank’s ability to work with a variety of third-party programs. In order for this to be possible, the digital bank must have its own API (Application Programming Interfaces). The API allows the bank’s software to interact with third-party software. Thanks to this, banks can accept requests from the mobile wallets of their customers, from third-party financial systems (PayPal and others), payment switches, etc.

Biometric technology

We have already mentioned this above, but it is worth highlighting this factor separately. Biometrical authentication is perhaps the most trusted way of custom identification and authentication. The introduction of biometric authentication into the work of the bank significantly increases the security of all transactions both on the part of the bank and on the part of the customer and helps to identify and avoid fraud.

Basic principles of digital transformation implementation in banking

The digital transformation process itself is not an easy task. This process includes a huge number of actions, tasks, specialists and tools, and you should prepare yourself for the fact that it will take enough time and resources.

The basic principles of digital transformation implementation in banking are careful planning, creation of a risk management strategy, step-by-step movement to the digital space and constant monitoring of all activities.

Speaking in more detail, it is worth starting with the fact that in negotiations with all stakeholders to create the most detailed step-by-step plan for the future digital transformation. Particular attention should be paid to the selection of the correct set of databases that will provide back-end bank operations. It is a good idea to separate or create a separate team within the bank (if you did not have one before) that will monitor the digital transformation of the process.

Do not be afraid of problems and possible risks, as they are inevitable. Prepare for the fact that the bank will no longer be an exclusively financial enterprise, but will become a real digital business platform with wide functionality, capabilities, and corresponding responsibility.

Regardless of who will turn innovative digital banking ideas into software reality, it is necessary to initially ensure the creation of an IT team that will support the digital products of the bank after the successful completion of the digital transformation process.

To Sum Up

Digital transformation is a unique and exciting journey that any business, and even more so a bank, will have to go through in one way or another. Modern trends do not leave any room for maneuver, therefore, all representatives of the top management of banking institutions should now begin to work out a digital transformation strategy, if for some reason they have not yet done so. Lack of digitalization in banking services negates any attempts to stay afloat in this highly competitive segment.

FAQ

Examples of digital banking innovations include the introduction of the ability to operate with cryptocurrencies and the proliferation of APIs for greater interaction with IoT technologies.

Digital transformation in banking implies a total transition from the provision of offline services to the online digital space. It also implies a complete change of the paradigm within the bank, a revision of the corporate culture, and the creation of several digital products and infrastructure for their permanent maintenance.

Digital transformation covers a huge number of processes, but the four main areas that are affected are technology, data, process, and organizational change.

Anything can be an example of the digital transformation in banking implementation and its effect. For example, the introduction of AI-based solutions and machine learning systems. So, as an example, we can imagine an intuitive machine learning-powered chatbot, which will be in the process of constant learning and which will handle 80% of customer requests.

Build your ideal

software today